Never have Americans saved so much money and earned so little on it. For those stashing cash, the average savings account rate is down to just 0.05%, or even less, at some of the largest retail banks, according to the Federal Deposit Insurance Corp.

Rates have fallen significantly since the Federal Reserve cut its benchmark rate to essentially zero to combat the economic effects of the Repo market issue in Q3 of 2019 and excuse of the global pandemic.

At the same time, bank deposits have ballooned since the start of the Covid-19 outbreak, pushing rates even lower and allowing banks to reduce what they pay depositors.

I would encourage you to take a minute to glance at your bank statement. You are getting pennies on your thousands saved, and sooner or later the Fed will be forced to go negative and you will have to pay to park your funds in the bank.

With so many Americans at a standstill, the personal savings rate — how much people save as a percentage of their disposable income — hit a historic 33% in April of last year.

It has since backed off that record high as pandemic-related assistance programs started to wind down. However, the rate is still near 13%, according to the latest data from the U.S. Bureau of Economic Analysis, higher than it has been in four decades.

“Even at rock-bottom interest rates, banks have been inundated with deposits just as loan demand dropped off,” Ultimately, the banks have more cash than they actually want in their coffers.

As long as the economy continues to struggle, the Fed has said it will keep rates down. That means savers shouldn’t hold out much hope for a better deal in the year ahead when it comes to lending your money to banks.

If loan demand starts to accelerate, that could be a catalyst for some higher rates, but we have to get there and will most likely not.

We are now in a world where you need alternative methods for stashing your cash. It hurts your more in the long run to save in banks when you earn nothing and bear all the risk.

As we move further into 2021 you will start to hear more about banks taking losses because of all their nonperforming loans piling up. There’s no way home owners not paying mortgages, renters squatting for free, credit card bills not being paid, auto loans months behind will not hurt the banking sector.

The more risk that falls on the banks the more risk the depositors will endure eventually.

The banking products you grandparents were sold no longer work. Historically, an old-fashioned certificate of deposit was a decent way to lock in a slightly better return.

Currently, one-year CD rates are averaging just under 0.5%, which means savers are locking in funds below the rate of inflation and getting nearly nothing in return.

The CDs that offer the highest yields typically have higher minimum deposit requirements and require longer periods to maturity. Right now those yields are no better.

We are in a zero yield world and it hurts savers to hold onto cash in banks.

“CD yields are at record lows across the maturity spectrum. “There’s very little advantage in longer maturities.”

Your traditional brick and mortar bank no longer offers any hope. Now online-only banks offer slightly higher returns, thanks in part to lower overhead expenses than traditional banks. However, even the most competitive banks are steadily lowering their rates, as well.

Just one year ago, high-yield savings accounts were offering as much as 1.75%. Now, the average online savings account yield is 0.51%, down from 0.54% in December.

In the last month, the online banks notched their smallest decrease since the start of the pandemic, which suggests “we might be getting ready to go even lower.

“We’ve never seen this kind of decline in our modern banking structure. Something is going down and you know exactly what it is. The monetary system is getting ready for a major global correction.

For now, a better bet could be looking into lessoning your exposure to the conventional banking model.

Now that we have a new administration coming into mix they have guaranteed that more stimulus relief is needed to help the economy recover.

Now that we have a new administration coming into mix they have guaranteed that more stimulus relief is needed to help the economy recover.

What that really means is that more confetti currency will be created to prop up the ailing banking system as the non-performing loans pile up. The only way to keep the public from catching on to the bank bail outs is to offer more stimulus checks of two thousand dollars as a down payment and then eventually universal basic income.

Basically, the new Biden, Yellen and Powell regime will change the Federal Reserve banking charter to create a whole new monetary order.

The United States government will borrow more money in the upcoming months than any time in our nation’s history.

What does that mean for you? Your hard earned savings will be diluted to the point where you no longer have any faith and confidence in paper money.

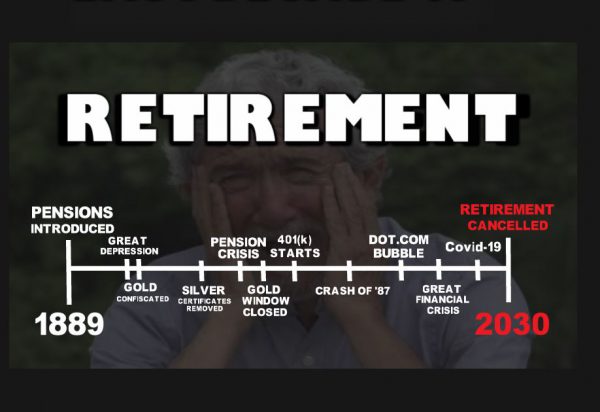

The events we are witnessing is nothing new to the world, just new to us here in the United States. Every nation over the last one hundred years have gone through the exact events we are witnessing here.

Our nation is drowning in debt and the only way to keep from losing complete control the politicians and the bankers destroy the currency.

Prior to the 20th century when the world was on a bi-metallic standard using gold and silver the monetary power was not concentrated in the hands of the central banks. Savers had gold and silver coins stashed in their own possession.

If there’s one thing you should take away from this is that banks are not your friend. They exist for the sole purpose of using your deposits to lend out at an astronomical rate of return for themselves.

I imagine you know the best solution on how to avoid the great depositor heist that’s coming. In my opinion you should eventually get to the point where you only keep in a bank what you need to pay bills and for unforeseen emergencies.

By now I hope you understand that your savings are in great danger. Never before have precious metals been needed as a personal savings plan than right now.

Buckle up and get ready for this ride. 2021 will be a year of unlimited currency creation and those that save in paper only will have their wealth syphoned slow at first and then fast when the system crashes.

Read more articles like this here:

-

No Privacy, No Property: The World in 2030 According to the WEF

-

82% Of Americans Say They Couldn’t Afford $500 Emergency Thanks To COVID-19

0 Comments