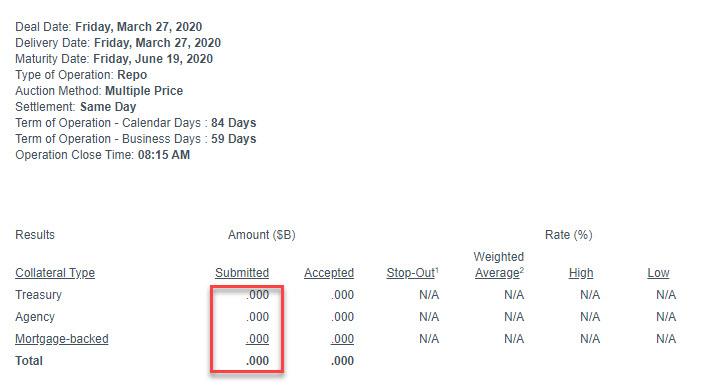

The Fed’s ongoing attempt to inject a record amount of liquidity into the financial system: on Friday morning, the Fed held a $500 billion term repo operation and nobody showed up.

There were zero submissions of either Treasury, Agency of MBS securities by Dealers who appear to have run out of securities, or are unwilling to pledge to the Fed.

Today’s “zero bid” auction was merely the logical endgame of a recent collapse in Treasury submissions into the Fed’s massive daily term and overnight repo operations, which climaxed two weeks ago, only to plunge as soon as the Fed announced the start of unlimited QE.

With dealers now able to sell unlimited amounts directly to the Fed, and at a premium to carrying values, most of them appear to have picked that option instead of holding on to paper that may be worthless especially with an avalanche of debt coming down the pipeline as the Treasury has to fund its $2 trillion corporate handout package.

“Why on Earth you would tie something up for three months in repo with the Fed buying,” said Ian Burdette, managing director at Academy Securities, who followed up with a very apt observation: “I think people are getting wise to the fact that an absolute tsunami of global sovereign debt issuance is on its way. Best to sell it all to the fed now probably.“

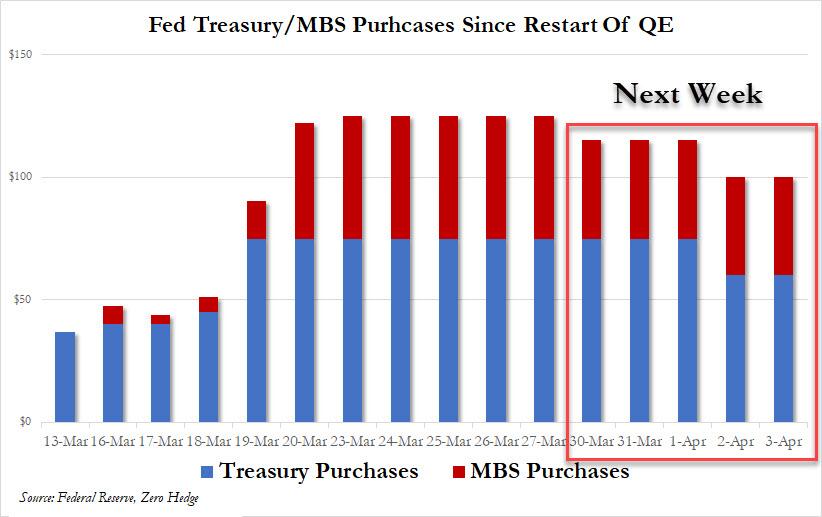

Another hint that the Fed may have overliquified the market, soaking up too much “safe, money-like collateral” such as Treasuries and MBS, and injecting too many reserves (i.e., cash) came from the Fed itself which 30 minutes before the close today announced it would taper “QE-unlimited” and cut the amount of TSY purchases starting April 1 from $75BN to $60BN, while also trimming its MBS QE from $50BN to $40BN.

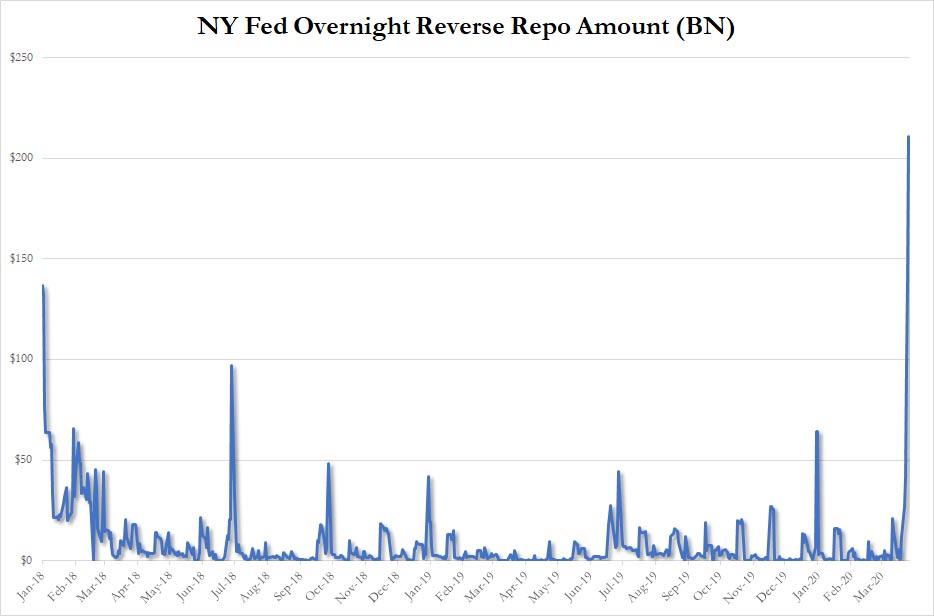

But the clearest hint yet that there has been a sea change in the US financial system, which has gone from reserve scarce to collateral(Treasury) scarce was in today’s fixed-rate reverse repo operation. As the name suggests, this is the opposite of repo, where instead of borrowing cash from the Fed in exchange for Treasury collateral, while paying a modest borrowing fee, Dealers borrow Treasurys in exchange for cash collateral.

If the presence of a reverse repo is news to some, there’s a reason for that: for much of the past 3 years, when the Fed was draining reserves as part of QT and banks were cash strained, there was an abundance of Treasurys.

Until today, because today’s reverse repo operation exploded to a record $210BN from $138.4BN yesterday, after virtually no usages for years.

This means that after scrambling to park treasuries at the Fed in exchange for cash, Dealers are now doing the opposite, because as a result of the Fed’s historic QE spree in which the Fed has bought $1 trillion in TSYs and MBS in the past two weeks, there is now an unexpected Treasury shortage among the financial community. Either that, or simply nobody wants to park their Treasurys with the Fed if they can sell them.

But don’t worry: if there is indeed a Treasury shortage, it won’t last. With the US Treasury on deck to issue hundreds of billions in debt in the coming weeks, a scarcity of US paper is the last thing the world will have to worry about…

Article originally appeared on Zerohedge.com

0 Comments