Global stocks continued to slide and investors sought the safety of government bonds, the yen, the Swiss franc and gold on the first trading day of June as rising trade tensions sparked fears of an upcoming recession (which according to Morgan Stanley will hit in 3 quarters or less, while JPMorgan said the probability of a U.S. recession in the second half of 2019 had risen to 40% from 25% a month ago) denting stocks again…

… sending the 10Y TSY yield as low as 2.07%, the lowest level in almost 21 months, after JPMorgan said it now expects the 10Y yield to drop to 1.75% by year end…

… pushing the inversion between the 3M and 10Y yield to a whopping 28 bps…

… and sending oil sliding close to bear market territory.

With no improvement in tone or sentiment between the US and China, and in fact with China striking a combative tone on Sunday, blaming the U.S. for the collapse in trade talks and saying it won’t be pressured into concessions after the White House rattled markets Friday by announcing tariffs on Mexican goods, the worsening trade and broader economic backdrop made for a jarring start to June after a torrid May that wiped $3 trillion off global equities.

Also over the weekend, China’s Defence Minister Wei Fenghe warned the United States not to meddle in security disputes over Taiwan and the South China Sea, after acting U.S. Defence Secretary Patrick Shanahan said Washington would no longer “tiptoe” around Chinese behaviour in Asia.

“We’re in a phase of brinkmanship — it’ll be a difficult month,” Rob Mumford, an emerging market portfolio manager at GAM Investments, said at a roundtable in Hong Kong. “We’re at the maximum pressure.”

US equity index futures all pointed to a drop at the open, though losses were pared modestly from earlier in the session. In Europe, the Stoxx 600 Index also came off its lows, with gains in food and healthcare shares offsetting declines in banks. European shares fell further and the Swiss franc jumped to a two-year high as Beijing sent another shot across Washington’s bows on trade and then euro zone data came in weak though the main groundswell was in bonds.

“No one now thinks a deal would be possible at the G20. It is going to be a prolonged battle. Investors are rushing to the safe assets,” Mitsubishi’s Fujito said.

German government bond yields dropped to a new record all-time lows of -0.219%, while those on two-year U.S. Treasuries were seeing their biggest two-day fall since early October 2008, when the global financial crisis was kicking off.

“Bonds are more or less on fire and I think we are going to spend the week with trade dominating everything else,” said SocGen fx strategist Kit Juckes. With German and UK political concerns and worries about Italy’s finances resurfacing too, “it is hard to think the yen is not going to be at least one of the winners this week.”

There was not flight to safety for Deutsche Bank, whose stock dropped to a new all time low, sliding below €6.00 for the first time ever after JPMorgan said DB’s issue is not about capital or liquidity but about poor operating profitability and it needs to stop “tinkering with its restructuring efforts.” The German bank “needs to make objective decisions about what business and/or asset can be closed or reduced”, JPM’s Kian Abouhossein and Amit Ranjan wrote, adding that CEO Sewing is “up to the challenge” to take action against status quo as he is over-delivering on cost targets. One look at the chart below suggests the market disagrees.

Asian stocks reversed an earlier decline as utilities and IT stocks boosted the regional index. Markets in the region were mixed. South Korea’s Kospi index and India’s S&P BSE Sensex Index rose, while Japan’s Topix index and Australia’s S&P/ASX 200 fell. The MSCI Asia Pacific Index climbed 0.2% in Hong Kong. The Kospi closed 1.3% higher, with Chasys Co. and Heung-A Shipping Co Ltd leading gains. India’s S&P BSE Sensex Index advanced 1.2%, led by basic materials and technology shares. Chinese shares ended little changed though the yuan faced pressure.

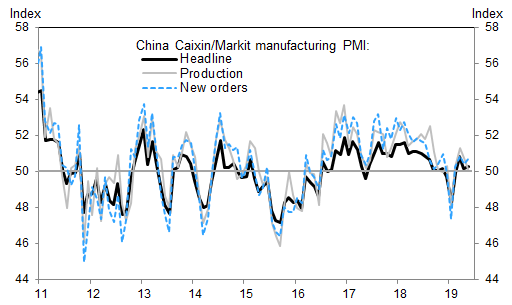

A private survey of China’s manufacturing sector published on Monday suggested a modest expansion in activity as export orders bounced from a contraction. In contrast to the fall in NBS manufacturing PMI, the Caixin manufacturing PMI was unchanged in May at 50.2, and above the 50.0 expected, although sub-indexes suggested weaker production, higher inventories and stronger new orders. Business confidence appeared to have deteriorated in light of lingering trade tension with the US.

Additionally, economists noted increases in new export orders pointed to possible front-loading of U.S.-bound shipments to avoid potential tariff hikes that U.S. President Donald Trump – who kicked off a potentially confrontational state visit to Britain on Monday – had threatened to slap on another $300 billion of Chinese goods. “Chinese companies probably see the current export conditions as severe as during the China shock in 2015,” said Wang Shenshen, economist at Tokai Tokyo Research Center.

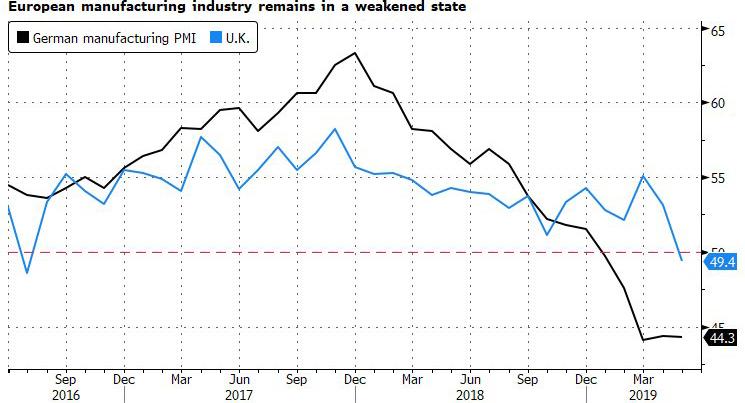

And speaking of economic headwinds, with the bitter trade weighing, factory activity contracted in most Asian countries and the euro zone last month, the latest PMI surveys showed. The eurozone’s slowdown was for the fourth month running, and at an accelerating pace, as slumping automotive demand, Brexit and wider political uncertainty took their toll. “The sector remains in its toughest spell since 2013,” said Chris Williamson, chief business economist at IHS Markit.” The UK mfg PMI also dipped below 50, indicating contraction.

Elsewhere, Emerging market stocks and currencies were heading for their biggest 3-day gain in two months as bets a sell-off last month had gone too far outweighed falling oil prices and renewed trade tensions. The MSCI Emerging Markets Index of stocks climbed to a two week high, while its currency counterpart traded above its 200-day moving average.

“Why should emerging markets sell off just because the U.S. is shooting itself in the head?” said Jan Dehn, Ashmore Group’s head of research based in London. “I can understand why Mexico sold off, but this is a policy mistake, which will hurt America. So it is only right that America is sold, not emerging markets.”

Asian currencies led by South Korea’s won were the best performers, while Chinese telecom stocks rallied after a report Beijing will issue commercial licenses for fifth-generation telecommunication services. The Yen rose, as did Europe’s go-to safety play, the Swiss franc, which rallied to its highest in nearly two years against the euro. The euro hovered at $1.1171 having been stuck in one of its tightest ranges ever against the dollar.

Brent crude fell for a fourth day, tumbling as much as 1.8% to $60.86 per barrel. Oil has dropped almost 20% since April, approaching a bear market. WTI futures dropped 1.3% too to below $53 a barrel for the first time since mid-February. Copper futures in Shanghai fell 0.5% to two-year lows while safe-haven gold jumped as much as 0.5% to a 10-week high of $1,312.4 per ounce.

Expected data include PMIs and construction spending. Box and Coupa Software are reporting earnings.

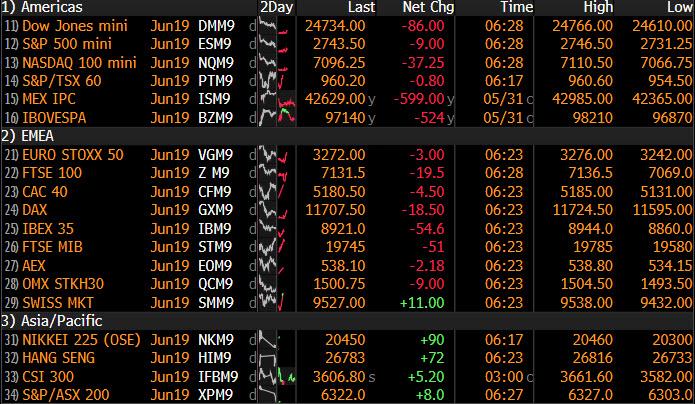

Market Snapshot

- S&P 500 futures down 0.4% to 2,742.00

- STOXX Europe 600 down 0.7% to 366.56

- MXAP up 0.2% to 152.60

- MXAPJ up 0.5% to 500.95

- Nikkei down 0.9% to 20,410.88

- Topix down 0.9% to 1,498.96

- Hang Seng Index down 0.03% to 26,893.86

- Shanghai Composite down 0.3% to 2,890.08

- Sensex up 1% to 40,124.89

- Australia S&P/ASX 200 down 1.2% to 6,320.55

- Kospi up 1.3% to 2,067.85

- German 10Y yield fell 1.1 bps to -0.213%

- Euro up 0.03% to $1.1172

- Italian 10Y yield rose 1.4 bps to 2.297%

- Spanish 10Y yield fell 2.7 bps to 0.688%

- Brent futures down 3.8% to $62.05/bbl

- Gold spot up 0.7% to $1,315.17

- U.S. Dollar Index little changed at 97.71

Top Overnight News from Bloomberg

- Trump landed in the U.K. for a three-day state visit at a sensitive time for the country’s ruling Conservative Party. Rival candidates are jostling to replace outgoing Prime Minister Theresa May, and the president has already weighed in with his own opinions on the contenders

- Trump opened another potential front in his trade war, terminating India’s designation as a developing nation and thereby eliminating an exception that allowed the country to export nearly 2,000 products to the U.S. duty-free. Meanwhile China was planning retaliatory trade measures against the U.S.

- China’s government says it’s willing to work with the U.S. to end an escalating trade war but blames President Donald Trump’s administration for the collapse in talks and won’t be pressured into concessions

- “We don’t have plans to change our inflation target, but are looking at our framework more broadly,” San Francisco Fed President Mary Daly says in reply to question after speech in Singapore

- President Trump on Saturday defended his decisions to impose or raise levies against imports from Mexico and China, respectively, saying “companies are moving to the U.S.” to avoid paying the levies

- Trump downplayed the chance he would impose tariffs on Australia, a top U.S. ally, after the New York Times reported his administration considered doing so last week

- With U.K. Prime Minister Theresa May about to hand over the reins of power, candidates to succeed her now feel free to speak out on issues such as Huawei Technologies Co. Ltd.’s role in the country’s 5G telecoms infrastructure

- The Social Democrats, the junior coalition partner in Germany’s government, will begin searching for an interim chief after Andrea Nahles said she lost the support of her party

- Factory output in the euro area fell close to a six-year low in May, with slumping orders and declining workforces signaling a bleak outlook for demand. The data underscores a picture of an economy that is struggling to emerge from a slowdown that has lasted more than a year

- Britain’s manufacturing sector unexpectedly shrank in May for the first time since the direct aftermath of the 2016 Brexit referendum. IHS Markit’s manufacturing PMI dropped to 49.4 from 53.1 in April as factories unwound Brexit preparations when the departure date was pushed back. The reading was weaker than the 52 forecast

- Deutsche Bank AG and UniCredit SpA moved some of their swaps trades from London to Frankfurt in May as banks used a lull in the ongoing Brexit drama to prepare for the worst

Asian equity markets traded negatively with risk appetite subdued as the US faces a 2-front trade war against China and Mexico, although stronger than expected Caixin PMI data helped limit losses in China. Nonetheless, a risk averse tone was seen from the reopen after China released a white paper that blamed the US for the setback of trade talks which pressured US equity futures to extend on the losses from Wall St’s worst May performance since 2010. ASX 200 (-1.2%) and Nikkei 225 (-0.9%) declined with the energy sector the underperformer in Australia after the recent oil slump, while safe-haven currency flows weighed on Tokyo stocks and with weakness in SoftBank exacerbated on reports of funding difficulties for its next USD 100bln tech fund. Hang Seng (U/C) and Shanghai Comp. (-0.3%) were initially higher after the PBoC maintained net liquidity through CNY 80bln of reverse repos and after Chinese Caixin Manufacturing topped estimates, although the gains were short-lived as trade concerns remained heavily in focus with China playing the blame game, while it is also set to draft its own blacklist of ‘unreliable’ entities and probe FedEx over possible infringement of Huawei’s legal rights regarding rerouted packages. Finally, 10yr JGBs were steady with only marginal gains seen despite the widespread risk aversion and the BoJ presence in the market for JPY 800bln in up to 5yr JGBs.

Top Asian News

- Bank of Jinzhou Auditors Resign Citing Loan Inconsistencies

- China’s Top Courier Gains as FedEx Targeted in U.S. Trade War

- SpiceJet Has ‘Offers’ for Stake in Indian Budget Airline

- Turkish Inflation Slows Again as Food Prices Bring Relief

Major European indices began the week lower in continuation from the Asia-Pac session which was weighed on by China releasing a white-paper blaming the US for the set back in trade talks and are to draft a ‘black-list’ of unreliable entities. Throughout the mornings trade bourses have been grinding higher but are still in negative territory [Euro Stoxx 50 -0.1%]; sectors are mixed on the day with some moderate outperformance seen in Utilities, which Nomura Quants note is not sufficient to trigger an excessive volatility shock as the sell-off in cyclicals in minimal compared with prior selloffs. Notable movers this morning include Infineon (-6.4%) who are near the bottom of the Stoxx 600 after it was reported that they are to acquire Cypress Semiconductors for an enterprise value of EUR 8bln; Co’s boards have already consented to this acquisition. Elsewhere, airline names are somewhat subdued after reports that the global airline industry is to record its lowest profit in five-years, particularly easyJet (-2.1%) which is also weighed on following reports that the Co. are this week to drop out of the FTSE 100 (-0.4%). At the other end of the Stoxx, and topping the DAX are Wirecard (+2.3%) following the CEO stating they expect an outstanding H1.

Top European News

- Euro-Area Manufacturing Remained Stuck in Its Slump in May

- U.K. Manufacturing Slips Into Contraction After Brexit Delay

- Danske Moves Toward Total Baltic Exit Amid Laundering Saga

- One Man’s $75 Million Perk Triggers Indignation in Denmark

- Glencore’s Executive Departures Hasten as Oil Chief Leaves

In FX, the dollar was little changed on the day thus far, following on from a relatively subdued session overnight as the index remains sub-98.00 ahead of this week’s key risk events which includes US ISM manufacturing PMI, ECB’s monetary policy meeting and US jobs data. The index remains near the middle of the intraday 97.57-80 range with gains capped by bleeding US yields.

- EUR/GBP – Hardly fazed on manufacturing PMI day in which the EZ number was unrevised (as expected) whilst UK’s manufacturing sector slipped into contraction, with new orders and employment both declining whilst stockpiling paused following the Brexit delay. Sterling remains dedicated to Brexit related development as new members line up for the Tory leadership, with the latest from Environmental Sectary Gove, a front runner, reportedly considering a further extension beyond October 31st, whilst leading candidate Johnson said that if he is elected, the UK will leave the bloc with or without a deal on Brexit day. EUR/USD remains within a relatively tight 1.1157-90 range with clean air to the upside until the 1.1200 handle. Beyond that, the pair’s 50 DMA resides around 1.1208 with resistance seen at 1.1264 (May high). Meanwhile, Cable hovers around the 1.2650 mark with little seen to the upside by way of near-term tech levels.

- CHF/JPY – Both firmer on the day, albeit the Yen to a lesser extent, in a continuation of the Trump triggered risk-off mood around the market. USD/JPY fell to whisker away from the 108.00 level (low 108.08) whilst its Franc counterpart slipped further below parity vs. the Greenback. Deutsche Bank recommends “good news rallies should be sold as trade tensions may get relief rallies” as the JPY-crosses “should remain under pressure”. It’s worth keeping in mind USD/JPY sees almost 1bln in option expiries at 108.00-15 ahead of supports at 107.77 and 107.27 (Jan 10 low and 61.8% Fib respectively) whilst USD/CHF sees its 200 DMA at 0.9959 (having already tested the level) ahead of its 200 WMA at 0.9847.

- AUD/NZD – Marginally firmer in the aftermath of optimistic China Caixin manufacturing data which provided the antipodeans with some relief following last week’s losses. AUD/USD hovers around the 0.6950 mark (high 0.6960, low 0.6928) despite a looming RBA rate cut, with participants on the look-out for guidance into the aggressiveness of the much-anticipated easing cycle. Meanwhile, its antipodean counterpart seems to be benefiting more as the AUD/NZD cross breached its 200 DMA (1.0624) as it tests the 1.0600 level ahead of its 50 DMA (1.0571)

In commodities, WTI and Brent futures are recovering off Asia-Pac lows with the former back above the 53.00/bbl handle and climbing towards the next round figure, whilst the latter is attempting to turn positive on the day having already dipped below the 61.00/bbl figure overnight. The weekend saw the release of Russian May crude production which stood at an 11-month low at 11.11mln BPD, down from last month’s 11.24mln BPD, although this was mainly due closures from the Druzbha pipeline due to oil contamination. Elsewhere, Saudi reported a M/M decline in oil output to 9.65mln BPD from the prior 10.05mln BPD, whilst the Kingdom’s energy minister stated that Saudi is committed to do whatever is required to stabilise the oil market. GS takes into account the supply/demand side concerns and net-net expects prices to remain volatile in the coming months, albeit around current levels. Turning to OPEC, the bank sees higher production from Saudi, Russia, UAE and Kuwait to offset Iranian and Venezuelan shortfalls. Thus, GS expects backwardation to persist in the coming months, whilst also revising lower its Q2 Brent forecast to 65.50/bbl from 72.50/bbl, also citing spare capacity created by a new Permian pipeline. Elsewhere, gold (+0.7%) benefits from its safe haven characteristics and extends gains above its 1300/oz level whilst copper prices are seeing some reprieve following last week’s slump as the red metal was underpinned by optimistic Caixin manufacturing data from China.

Goldman Sachs suggest that oil prices may recover from here due to a tight EU crude market, sudden moves lower, OPEC’s reluctance to increase supply and above consensus growth forecasts, However, increasingly uncertain macro outlook, rising production an OPEC spare capacity suggests prices at likely to remain around current levels with high volatility

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 50.6, prior 50.6

- 10am: ISM Manufacturing, est. 53, prior 52.8

- 10am: Construction Spending MoM, est. 0.4%, prior -0.9%

- Wards Total Vehicle Sales, est. 16.9m, prior 16.4m

DB’s Jim Reid concludes the overnight wrap

Obviously being a Liverpool supporter it was a glorious weekend for me. Not even the kids could spoil it although on Saturday we went out strawberry picking as a family and aimed to leave at 930am but eventually left hot, bothered and bad tempered at 1pm. There were tantrums, numerous toilet related accidents, several changes of clothes, more tantrums, buckets of suncreams to apply, sunglasses to find, pack lunches to prepare etc etc. Originally we finally got ready to leave 2 hours late and then as we reversed the car we found that our electric gates wouldn’t open. After 30mins of failed brute force we called someone out. They came in an hour, fixed it and off we went 3.5 hours late. As for the final it was an awful game. In fact given it was Europe’s premier sporting occasion and given that it featured two English sides I’d imagine those in Brussels this morning will be lobbying extensively for the hardest possible Brexit so they don’t have to watch such a poor spectacle again. Anyway a great result… for me at least.

Markets have been on the wrong end of some bad results over the past month and after a strong 2019 up until the end of April, May was a big risk-off month with this trend accelerating over the last week. Craig has already published the May/YTD/QTD performance review(link here ) this morning so please see that for more but the highlights are Bunds going from 0% to a multi-century record low of -0.202% and the S&P500 (-6.2%) having its 3rd worst month in the last 92 behind only December and September last year which saw declines of -9.0% and -6.8% respectively. We’ll review the last week in a bit more detail later on but the highlight on Friday was a 13.9bp rally for 2yr US Treasuries (24.2bps on the week – the most for nearly a decade) as the probability of multiple US rate cuts this year surged as the out of the blue Mexican tariffs added to the recent Chinese ones. I suppose one of the additional worries would be that if the US has been so quick to escalate the trade war on these two countries the bar must be a bit lower to carry out a trade assault on Europe at some point in the future. Interesting times.

Quickly looking forward to this week before we analyse the weekend news, the data highlights will be the final global manufacturing PMIs and US ISM (today), the services and composite PMIs/US ISM (Wednesday), the latest ECB meeting (Thursday) and then another payroll Friday to end the week. The US ISM today may be the key release. The consensus expects a 0.2pt increase to 53.0 however our US economists have highlighted that in the current business cycle, the new exports orders components has led the headline by 5 months, and that the recent sharp downtrend in new export orders does not bode well. In the background we are still waiting for the date of a potentially China hawkish speech from US VP Pence (rumoured to have been moved from tomorrow’s 30th anniversary of the Tiananmen Square incident, maybe to avoid being maximum inflammatory). It could still be this week and likely be a big event. In terms of Fedspeak, the big event is the long awaited Fed research conference on “Monetary Policy Strategy, Tools, and Communications Practices” tomorrow and Wednesday. The future of how to interpret the 2% inflation mandate is the most widely anticipated part of the get together but this will likely be nearer the start of the conversation rather than the end of it. So so don’t expect a revolution yet.

China’s May Caixin manufacturing PMI has already been published overnight and it has diverged a touch from the official PMI from Friday as it slightly beat expectations at 50.2 (vs. 50.0 expected). Surprisingly, the commentary alongside the release said that the new orders component continued to rise over the previous month. However, the output sub-index fell to 50.1 (vs. 50.7 in last month), the lowest reading since January 2019. China also held a press conference yesterdayandissued a white paper outlining their official position on the trade talks. Theystated that the US ‘should bear the sole and entire responsibility’ for the breakdown in negotiations. Vice Commerce Minister Wang Shouwen didn’t overly escalate matters though and said that China is willing to work with the U.S. to find solutions, but the latter’s strategy of maximum pressure and escalation can’t force concessions from China. The white paper reiterates what the Chinese have recently suggested they require for a trade deal – a) US should remove all additional tariffs, b) China’s purchases of goods from the U.S. should be realistic, and c) there should be a proper balance in the text of the agreement. China has also launched an investigation into FedEX for ‘wrongful delivery of packages’, with the state broadcaster CCTV saying the investigation ‘will be a warning to other warning companies, organisations and individuals violating China’s rules and regulations’. This came after news at the end of last week that the Chinese are drafting an ‘unreliable entity list’ of foreign companies. So tensions are continuing to build.

Elsewhere, President Trump has said overnight that he is “really okay” with imposing tariffs on Mexico over illegal immigration if an agreement can’t be reached on stemming the flow of migrants at the border. He added that Mexico is sending a “big delegation” to the White House on Wednesday and we will see “what can be done, but if it’s not done, you know what we’re going to be doing, and, uh, I’m really okay with that.” On a more dovish note, Mr Trump downplayed a New York Times report which said that his administration considered imposing tariffs on Australia last week. Trump’s response to the report was that the US has very strong ties with Australia and he didn’t mention tariffs. Meanwhile, President Trump has said that his top economic adviser Kevin Hassett will leave the White House shortly and he will name his replacement “soon” after he returns from a trip to Europe this week.

Markets in Asia have started the week on largely negative footing with the Nikkei (-1.26%), Hang Seng (-0.35%) and Shanghai Comp (-0.49%) all lower while the Kospi (+0.84%) is up. The Japanese auto index is down a further -1.04% this morning after declining -3.60% on Friday. All the G10 currencies are trading slightly stronger (+0.10-0.30%) this morning. Elsewhere, futures on the S&P 500 are down -0.54% while oil prices (WTI -0.95% and Brent -1.39%) are also weak. In other overnight data releases, Japan’s final May manufacturing PMI came in two tenth above the preliminary read at 49.8 (vs. 50.2 in last month) while capital spending in Q1 remained strong at +6.1% yoy (vs. +2.6% yoy expected).

Elsewhere Andrea Nahles, the head of junior German coalition partner the SPD, resigned yesterday throwing ever more questions out there about the sustainability of the coalition.

Recapping Friday’s and last week’s market action now, the moves were dominated by the trade-war escalation and generally poorer economic data. The S&P fell -2.62% in a holiday-shortened week for its worst weekly performance of the year, sliding early in the week before staging a modest recovery on Thursday that was subsequently erased after the Mexico tariff induced selloff on Friday (-1.32% on Friday). That was the fourth consecutive weekly decline, a streak that hasn’t occurred since October 2014. Other US indexes staged similar moves, with the DOW and NASDAQ down -3.01% and -2.41% (-1.41% and 1.51% Friday), respectively. Some cyclical sectors lagged, with banks down -3.96% (-1.53% Friday), with other recent laggards actually outperforming with the Philly semiconductor index down only -1.20% (-1.45% Friday).

That poor move by banks was largely attributable to the sharp move lower in bond yields, as treasuries rallied on risk aversion and tepid inflation data. Ten-year yields fell -18.7bps (-8.0bps Friday) but the real action was in the front end, where 2-year yields fell -24.2bps (-13.9bps Friday) for their sharpest weekly move in almost 10 years. US core PCE for the first quarter was revised lower by 0.3pp to 1.0% on an annualised quarter-on-quarter rate. That’s significantly below the Fed’s target, and though there remains scope for inflation to rise over the next several months and quarters, the market is pricing full-on easing from the Fed now. Futures prices now imply 55bps of cuts this year, an additional 34bps of cuts compared to the preceding week. The sharp repricing in the front end is keeping the 2y10y yield curve in positive territory though, as it rose +4.4bps this week to 19.8bps (4.8bps Friday).

Other global equity indexes followed the US lower, with the STOXX 600 down -1.82% (-0.81% Friday) and European banks ending -3.22% (-1.67% Friday), back to their lowest level since December’s mini meltdown. Bunds rallied, though not as sharply as treasuries, with yields dropping -8.5bps to a new all-time low of -0.20% (-2.7bps). Italian BTPs notably underperformed, with yields rising +11.6bps (+1.4bps Friday), in the face of generalised safe haven flows into bonds. In credit, European HY cash spreads widened +14bps (+8bps Friday), while spreads in the US staged their worst performance of the year, widening +38bps (+20bps Friday). Despite all the carnage in equities and credit, the VIX and V2X remained surprisingly calm, rising only +2.9pts and +0.7bps (+1.4pts and +0.7pts Friday) to 18.71 and 17.42 respectively.

Article originally appeared on ZeroHedge.com (HERE)

0 Comments