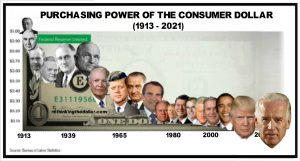

In the United States, approximately one-quarter of all U.S. dollars ever created were printed since the beginning of the coronavirus pandemic, adding more than $4 trillion to the nation’s money supply. This should be very alarming for the purchasing power of your dollars.

What about the rest of the world?

Across the globe, nations have been printing money to cover the price tag of their exorbitant coronavirus-related stimulus and relief packages, as well as the explosive health care costs to treat the population. Many cash-strapped nations’ financial conditions had been dreadful even before the COVID-19 public health crisis, so the astronomical expenses that spawned in 2020 exacerbated their plight.

From Lebanon to Argentina, the only solution for these places had been to turn on the printing press. The world is now beginning to watch the horror of these compounding problems unfold: currency crises, civil unrest, economic collapse, and a resurgence of coronavirus cases.

While the pandemic may be subsiding worldwide, the consequences of inflation are arising on the other side of the lockdowns. As a result, developing countries are enduring the pain fostered by central banks.

And the U.S. might be next. For now, it is imperative to find out what is transpiring around the world.

Lebanon Travels to Hell in a Handbasket

Local headlines call the situation in Lebanon “misery compounded.”

Intensifying shortages, climbing price inflation, and political unrest are the dominant themes in today’s Lebanon. Coronavirus infections are in the low single digits, but it does not mean the agony from the lockdowns has been eviscerated.

In May, the consumer price index (CPI) spiked to 119.83 percent year-over-year, according to the Central Administration of Statistics. But inflation has gotten so bad that the federal government has chosen to refrain from publishing monthly statistics. This is on top of the Lebanese pound losing about 95 percent of its value since the end of 2019, with the currency trading 15,340 against the U.S. dollar.

The central bank has been sounding the inflation alarm for months, warning policymakers that the government’s subsidy scheme to keep products on shelves would no longer be available since foreign exchange reserves are diminishing. As a result, some of the subsidies have been removed, resulting in dramatic increases in the cost of bread, coffee, sugar, and fuel.

When the bread is either too expensive or non-existent, it is clear that an economic collapse is unfolding.

Don’t Cry for Me Argentina

The Argentine peso has been in a perpetual freefall since the election of President Alberto Fernandez. The night following his electoral victory, the peso collapsed roughly 25 percent overnight. Investors were concerned about the government’s spending plans that would inevitably trigger higher inflation, much like what happened under his running mate, Cristina Fernandez de Kirchner, less than a decade ago.

Last year, the peso shed 42 percent of its value. At the same time, prices are skyrocketing, with food costs popping at an annualized rate of 50 percent in May. On a month-over-month basis, food prices rose 3.1 percent. Overall, Buenos Aires is suffering from a mix of currency devaluation and expanding prices.

Officials are not optimistic about the inflation situation for the remainder of the year. The Fernandez government is penciling in a registered inflation rate of 29 percent in 2021, but other private-sector economists think the real number is anywhere between 49 percent and 60 percent.

“The inflation figure for May is lower than that of April, but we must continue because we are still at levels that are above what we consider should be aligned with what is macroeconomically feasible,” said Minister of Economy Martin Guzman during a meeting organized in Buenos Aires by the Argentine chapter of the Inter-American Council of Commerce and Production.

If the conditions were not dire enough, Argentina is going through another debt crisis as the president and his administration attempt to push back $44 billion in payments to the International Monetary Fund (IMF) by four years. Thus, it appears that the South American country is in a perpetual financial crisis.

Bolivars for Empanadas in Venezuela

Surprisingly, empanadas have played an essential part in Venezuelan society throughout its humanitarian crisis, from citizens using bolivar currency to hold their hot empanadas to President Nicolas Maduro taking a bite out of the fried turnover in a speech to a hungry population.

The country is coming off its second-longest hyperinflation stretch in the nation’s history, topping 300,000 percent. Today, the annual inflation rate has declined to 2,400 percent. The central bank claims it has lowered the registered monthly inflation reading to 28.5 percent. President Maduro and his henchmen believe they have found a solution: Redenomination. Caracas is cutting six zeroes off the bolivar to simplify transactions.

The economic downturn has become so bad that the government needs to remove a half-dozen zeroes to ease transactions.

After socialism destroyed the Latin American country’s economy, President Maduro is trying everything, whether handing over state-owned assets to the private sector to easing price controls on some products.

In the meantime, Venezuelans are resorting to cryptocurrency to try to protect their assets. The problem? Rolling blackouts that are restricting access to their holdings.

The Lira Drowning in a Turkish Bath

The Turkish lira was on the road to recovery after President Recep Tayyip Erdogan tapped Naci Agbal as the central bank’s new chief. Foreign exchange markets were confident that Agbal would steer the ship back to safety following years of mismanagement and inept leadership – and soaring inflation. In addition, a more orthodox approach to monetary policy was in the cards.

However, in March 2021, President Erdogan sacked his third central bank head in a year, replacing him with someone who supports his economic views, including lower interest rates to grow the economy.

This personnel shift stunned markets, triggering an enormous selloff that saw the lira fall to a fresh record low of 8.8022 against the greenback. The lira had endured several new all-time lows over the last 12 months, causing another currency crisis. Although Ankara was one of two major economies to report growth during 2020 – China being the other one – it has suffered an inflationary calamity.

According to the Turkish Statistical Institute (TSI), the inflation rate is closing in on 20 percent, thanks to previous central bank policymakers eating forex reserves, slashing interest rates, and printing money to support economic growth. The economy might have survived the COVID-19 public health crisis, but at what cost?

Uncle Sam Wants You … to Pay More with Less?

The U.S. economy is far from experiencing the same level of inflation that is occurring in these countries. But that does not mean America is immune from 1970s-style price inflation. All measurements point to ballooning price inflation.

The annual inflation rate has hit 5%, the cost aspects of purchasing managers’ index (PMI) readings have risen, and the producer price index (PPI) has exceeded 7%. Thus, not only do consumers need to endure higher prices amid reduced purchasing power, but they also need to contend with stealth inflation – businesses that pass on added production costs to shoppers.

Bank of America has been adamant that higher inflation is coming to the U.S., even going as far as sounding the alarm over temporary hyper inflation.

During the latest earnings call commentary, BofA said, “Buckle up! Inflation is here.” The bank noted that the mentions of “inflation” have quadrupled from the same time last year, rising close to 800% year-over-year. “On an absolute basis, [inflation] mentions skyrocketed to near record highs from 2011, pointing to at the very least, ‘transitory’ hyper-inflation ahead,” the BofA added.

Should the inflation data fall short of these hyperinflation warnings, it is more than likely that the chickens will come home to roost for America. Put simply, savers’ assets will depreciate in value, retirees will need to adapt to higher living costs, and households will have to employ measures to diminish the harmful effects of price inflation.

But what can the public do to shield their hard-earned dollars and cents from this odious force?

Preserve Purchasing Power

Metals

Gold, silver, and other tangible assets are typically the go-to asset to protect your wealth from higher prices and decreased purchasing power. While paper gold (mining stocks and metal exchange-traded funds (ETFs)) is the easiest way to possess precious metals, physical gold and silver are far more preferable to preserve your money.

Be it bars or coins, it is always better to hold them in your hands.

Dividend Stocks

One of the reasons why central banks slash interest rates is to push investors into the equities arena, buying stocks to chase higher yields. In this environment of near-zero rates, you will receive a nickel, dime, quarter, or buck for your savings. Is this fair? Is it enough to defeat inflation? When real interest rates are essentially zero, the easy answer is no. As a result, dividend-paying stocks are generally a good idea to produce income and defend your principal investment.

Remember, the objective of investing in stocks is to protect your principal. So when this becomes your go-to strategy, you can ensure your money enjoys an added layer of protection.

Cryptocurrency?

Is cryptocurrency a reliable investment vehicle in times of inflation to preserve purchasing power? This can be challenging to determine since bitcoin, Ethereum, litecoin, and a plethora of other digital currencies have yet to trade in an inflationary environment – until now. For example, during Argentina’s debt and inflation crisis several years ago, consumers decided to convert all their pesos into a broad array of assets: luxury vehicles, real estate, and bitcoin.

Will this happen in America? Once the public learns more about how easy it is to buy and sell crypto, and how certain coins, like bitcoin, are not susceptible to inflation, perhaps more retail investors will pour into digital tokens and crypto ETFs.

Morning in America?

The real inflation rate is much higher than what the U.S. government is telling you. John Williams’ Shadow Government Statistics hub places it at about eight percent. Real interest rates in the United States are in subzero territory. The Federal Reserve’s M2 money supply growth continues accelerating. Consumer and producer prices are advancing.

The White House and the Eccles Building might tell you that it is morning in America again, but it is actually mourning in America.

Read more articles from the RTD blog:

- The Handshake That Ended the Dollar Reserve Status

- 5 Reasons Why Quantitative Easing Will Kill Retirement

- George Orwell’s 1984 Has Become a Blueprint for Our Dystopian Reality

0 Comments