In 2016, I first touched on the impacts of hiking the minimum wage.

“What’s the big ‘hub-bub’ over raising the minimum wage to $15/hr? After all, the last time the minimum wage was raised was in 2009.

According to the April 2015, BLS report the numbers were quite underwhelming:

‘In 2014, 77.2 million workers age 16 and older in the United States were paid at hourly rates,representing 58.7 percent of all wage and salary workers. Among those paid by the hour, 1.3 million earned exactly the prevailing federal minimum wage of $7.25 per hour. About 1.7 million had wages below the federal minimum.

Together, these 3.0 million workers with wages at or below the federal minimum made up 3.9 percent of all hourly-paid workers. Of those 3 million workers, who were at or below the Federal minimum wage, 48.2% of that group were aged 16-24. Most importantly, the percentage of hourly paid workers earning the prevailing federal minimum wage or less declined from 4.3% in 2013 to 3.9% in 2014 and remains well below the 13.4% in 1979.’”

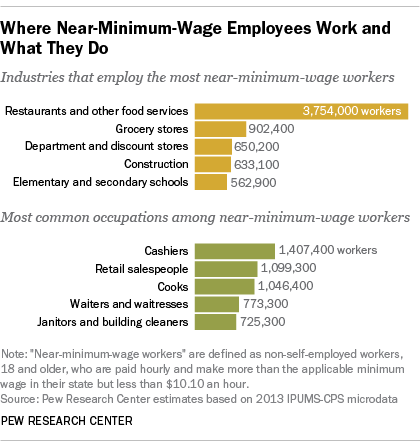

Hmm…3 million workers at minimum wage with roughly half aged 16-24. Where would that group of individuals most likely be found?

Not surprisingly, they primarily are found in the fast-food industry.

“So what? People working at restaurants need to make more money.”

Okay, let’s hike the minimum wage to $15/hr. That doesn’t sound like that big of a deal, right?

My daughter turned 16 in April and got her first summer job. She has no experience, no idea what “working” actually means, and is about to be the brunt of the cruel joke of “taxation” when she sees her first paycheck.

Let’s assume she worked full-time this summer earning $15/hour.

- $15/hr X 40 hours per week = $600/week

- $600/week x 4.3 weeks in a month = $2,580/month

- $2580/month x 12 months = $30,960/year.

Let that soak in for a minute.

We are talking paying $30,000 per year to a 16-year old to flip burgers.

Now, what do you think is going to happen to the price of hamburgers when companies must pay $30,000 per year for “hamburger flippers?”

Not A Magic Bullet

After Seattle began increased their minimum wage, the NBER published a study with this conclusion:

“Using a variety of methods to analyze employment in all sectors paying below a specified real hourly rate, we conclude that the second wage increase to $13 reduced hours worked in low-wage jobs by around 9 percent, while hourly wages in such jobs increased by around 3 percent.Consequently, total payroll fell for such jobs, implying that the minimum wage ordinance lowered low-wage employees’ earnings by an average of $125 per month in 2016.”

This should not be surprising as labor costs are the highest expense to any business. It’s not just the actual wages, but also payroll taxes, benefits, paid vacation, healthcare, etc. Employees are not cheap, and that cost must be covered by the goods or service sold. Therefore, if the consumer refuses to pay more, the costs have to be offset elsewhere.

For example, after Walmart and Target announced higher minimum wages, layoffs occurred (sorry, your “door greeter” retirement plan is “kaput”) and cashiers were replaced with self-checkout counters. Restaurants added surcharges to help cover the costs of higher wages, a “tax” on consumers, and chains like McDonald’s, and Panera Bread, replaced cashiers with apps and ordering kiosks.

A separate NBER study revealed some other issues:

“The workers who worked less in the months before the minimum-wage increase saw almost no improvement in overall pay — $4 a month on average over the same period, although the result was not statistically significant. While their hourly wage increased, their hours fell substantially.

The potential new entrants who were not employed at the time of the first minimum-wage increasefared the worst. They noted that, at the time of the first increase, the growth rate in new workers in Seattle making less than $15 an hour flattened out and was lagging behind the growth rate in new workers making less than $15 outside Seattle’s county. This suggests that the minimum wage had priced some workers out of the labor market, according to the authors.”

Again, this should not be surprising. If a business can “try out” a new employee at a lower cost elsewhere, such is what they will do. If the employee becomes an “asset” to the business, they will be moved to higher-cost areas. If not, they are replaced.

Here is the point that is often overlooked.

Your Minimum Wage Is Zero

Individuals are worth what they “bring to the table” in terms of skills, work ethic, and value. Minimum wage jobs are starter positions to allow businesses to train, evaluate, and grow valuable employees.

- If the employee performs as expected, wages increase as additional duties are increased.

- If not, they either remain where they are, or they are replaced.

Minimum wage jobs were never meant to be a permanent position, nor were they meant to be a “living wage.”

Individuals who are capable, but do not aspire, to move beyond “entry-level” jobs have a different set of personal issues that providing higher levels of wages will not cure.

Lastly, despite these knock-off effects of businesses adjusting for higher costs, the real issue is that the economy will quickly absorb, and remove, the benefit of higher minimum wages. In other words, as the cost of production rises, the cost of living will rise commensurately, which will negate the intended benefit.

The reality is that while increasing the minimum wage may allow workers to bring home higher pay in the short term; ultimately they will be sent to the unemployment lines as companies either consolidate or eliminate positions, or replace them with machines.

There is also other inevitable unintended consequences of boosting the minimum wage.

The Trickle Up Effect:

According to Payscale, the median hourly wage for a fast-food manager is $11.00 an hour.

Therefore, what do you think happens when my daughter, who just got her first job with no experience, is making more than the manager of the restaurant? The owner will have to increase the manager’s salary. But wait. Now the manager is making more than the district manager which requires another pay hike. So forth, and so on.

Of course, none of this is a problem as long as you can pass on higher payroll, benefit and rising healthcare costs to the consumer. But with an economy stumbling along at 2%, this may be a problem.

A report from the Manhattan Institute concluded:

“By eliminating jobs and/or reducing employment growth, economists have long understood that adoption of a higher minimum wage can harm the very poor who are intended to be helped.Nonetheless, a political drumbeat of proposals—including from the White House—now calls for an increase in the $7.25 minimum wage to levels as high as $15 per hour.

But this groundbreaking paper by Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office, and Ben Gitis, director of labormarket policy at the American Action Forum, comes to a strikingly different conclusion: not only would overall employment growth be lower as a result of a higher minimum wage, but much of the increase in income that would result for those fortunate enough to have jobs would go to relatively higher-income households—not to those households in poverty in whose name the campaign for a higher minimum wage is being waged.”

This is really just common sense logic but it is also what the CBO recently discovered as well.

The CBO Study Findings

Overall

- “Raising the minimum wage has a variety of effects on both employment and family income. By increasing the cost of employing low-wage workers, a higher minimum wage generally leads employers to reduce the size of their workforce.

- The effects on employment would also cause changes in prices and in the use of different types of labor and capital.

- By boosting the income of low-wage workers who keep their jobs, a higher minimum wage raises their families’ real income, lifting some of those families out of poverty. However, real income falls for some families because other workers lose their jobs, business owners lose income, and prices increase for consumers. For those reasons, the net effect of a minimum-wage increase is to reduce average real family income.”

Employment

- First, higher wages increase the cost to employers of producing goods and services. The employers pass some of those increased costs on to consumers in the form of higher prices, and those higher prices, in turn, lead consumers to purchase fewer goods and services.

- The employers consequently produce fewer goods and services, so they reduce their employment of both low-wage workers and higher-wage workers.

- Second, when the cost of employing low-wage workers goes up, the relative cost of employing higher-wage workers or investing in machines and technology goes down.

- An increase in the minimum wage affects those two components in offsetting ways.

- It increases the cost of employing new hires for firms

- It also makes firms with raise wages for all current employees whose wages are below the new minimum, regardless of whether new workers are hired.

Effects Across Employers.

- Employers vary in how they respond to a minimum-wage increase.

- Employment tends to fall more, for example, at firms whose sales decline when they raise prices and at firms that can readily substitute machines or technology for low-wage workers.

- They might reduce workers’ fringe benefits (such as health insurance or pensions) and job perks (such as employee discounts), which would lessen the effect of the higher minimum wage on total compensation. That, in turn, would weaken employers’ incentives to reduce their employment of low-wage workers.

- Employers could also partly offset their higher costs by cutting back on training or by assigning work to independent contractors who are not covered by the FLSA.

Macroeconomic Effects.

- Reductions in employment would initially be concentrated at firms where higher prices quickly reduce sales. Over a longer period, however, more firms would replace low-wage workers with higher-wage workers, machines, and other substitutes.

- A higher minimum wage shifts income from higher-wage consumers and business owners to low-wage workers. Because low-wage workers tend to spend a larger fraction of their earnings, some firms see increased demand for their goods and services, which boosts the employment of low-wage workers and higher-wage workers alike.

- A decrease in the number of low-wage workers reduces the productivity of machines, buildings, and other capital goods. Although some businesses use more capital goods if labor is more expensive, that reduced productivity discourages other businesses from constructing new buildings and buying new machines. That reduction in capital reduces low-wage workers’ productivity, which leads to further reductions in their employment.

Don’t misunderstand me.

Hiking the minimum wage doesn’t affect my business at all as no one we employee makes minimum wage. This is true for MOST businesses.

The important point here is that the unintended consequences of a minimum wage hike in a weak economic environment are not inconsequential.

Furthermore, given that businesses are already fighting for profitability, hiking the minimum wage, given the subsequent “trickle up” effect, will lead to further increases in automation and the “off-shoring” of jobs to reduce rising employment costs.

In other words, so much for bringing back those manufacturing jobs.

Article originally appeared on Realinvestmentadvice.com here..

0 Comments