It started off well enough, with lots of “optimism” that a trade deal was just around the corner thanks to flashing red headlines from first Larry Kudlow and then China on Monday. However, shortly after 3am ET it all started going terribly wrong as first we got some negative Brexit news, when a Downing Street source said that unless the EU compromises and does a Brexit deal shortly, then the UK will leave the EU without a deal, which was then followed by the main event, namely China’s Ministry of Commerce saying to “stay tuned” for a blacklist retaliation.

That was just the start however, as China also said it will halt NBA broadcasts, further souring the mood music ahead of the trade talks scheduled this week, while shortly after the SCMP reported that this week’s trade talks were as good as dead when a “source” told the South China Morning Post that the Chinese delegation may cut short their stay in Washington, removing the possible chance of the talks extending into Friday evening as the delegation would be expected to head to the airport instead of departing at some point on Saturday.

Then, just moments later, Bloomberg doubled down on its originally refuted of soft capital controls by the US on China, when it reported that the Trump administration “is moving ahead with discussions around possible restrictions on capital flows into China, with a particular focus on investments made by U.S. government pension funds” adding that “the efforts are advancing even after American officials pushed back strongly against a Bloomberg News report late last month that a range of such limits was under review. Trump officials last week held meetings on the issue just hours after White House adviser Peter Navarro dismissed the report as “fake news,” and zeroed in on how to prevent U.S. government retirement funds from financing China’s economic rise.”

Faced with this mountain of evidence that the odds of even a watered down deal being announced this week are virtually nil, futures plunged, with the Emini sliding from session highs of 2,950 to as low as 2,910, wiping out almost all post-payrolls gains…

… while global markets had deteriorated to a sea of read despite a solid Asian session.

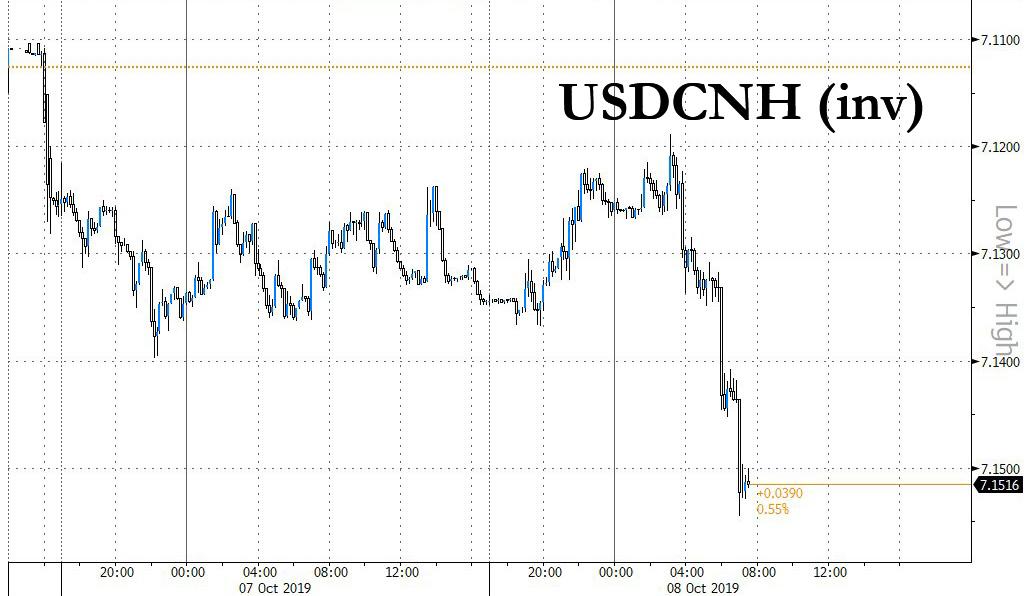

The news also slammed the offshore yuan, which tumbled 0.5% after earlier climbing the most in a month:

The barrage of negative news hit the European STOXX 600 index, which dropped as much as 1%, with Germany’s trade-sensitive DAX hit hard despite earlier data showing an unexpected rise in industrial output. Mixed corporate news added to the woes, with LSE shares tumbling 6% after Hong Kong pulled out of its takeover bid for the exchange, while Germany biotech Qiagen has plunged 16.5% to three-year lows after a sales warning.

Ironically, Europe’s losses followed healthy gains in Asia, where Japan’s Nikkei climbed 1.0% while MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.55%, led by gains in tech shares in South Korea and Taiwan. Hong Kong extended gains after the territory’s leader said she had no plans to introduce other laws using the emergency regulation ordnance, as it’s too early to say the anti-mask law is ineffective. On the other hand, reports, citing the Chief Executive, noted that the Chinese military could step in if the ongoing protests in the city get worse. The Hong Kong leader also noted that during Golden week, the number of visitors declined 50% Y/Y.

Also of note, China mainland stocks returned from a week-long holiday with a 0.6% rise. The National Holiday celebrations also offered a rare respite to China’s retail sector, with spending on goods and dining returning to growth this year. Yet the latest PMI survey showed China’s services sector grew at its slowest pace in seven months in September, offering little momentum to an economy that has been expanding at its weakest pace in almost three decades.

Source: Bloomberg

Emerging-market stocks advanced as Chinese markets re-opened after a week-long holiday, with most closing as investors still basked in the glow of the positive trade deal sentiment, as China confirmed that a high-level delegation had already left for the talks in Washington, while President Donald Trump said “we’ll see” if a deal could be reached. Of course, all that changed in subsequent hours, but it was too late to hit the majority of EM stocks.

All this happens, of course, as negotiations are getting under way ahead of a scheduled increase in U.S. tariffs on $250 billion worth of Chinese goods, to 30% from 25% on Oct. 15. Trump has said the tariff increase will take effect if no progress is made in the negotiations.

“Since tariffs have been hurting trade, people are hoping Trump may postpone some of the upcoming tariffs,” said Yukino Yamada, senior strategist at Daiwa Securities. “Nevertheless, you can’t ignore that fact that, up until now, the market has underestimated Trump’s determination on tariffs.”

The surge in trade deal uncertainty also added to pressure in fixed income markets with German bund yields nudging lower while U.S. Treasuries yields slumped as low as 1.52% despite some $78 billion in note and bond supply slated for auction this week.

Meanwhile in currencies, the dollar initially lost momentum, dipping 0.1% against a basket of its rivals after posting its biggest single-day rise in a week in the previous session, before rebounding to unchanged. The greenback traded as low as 106.80 yen, after hitting 107.44 earlier. The euro got a boost from the healthy German industrial output data, with the single currency rising 0.2% to $1.0988, not far off the more than a two-year low hit last week.

Besides the yuan, the other big mover was the pound sterling which traded at $1.2217, after Boris Johnson told German Chancellor Angela Merkel a Brexit deal is essentially impossible if the EU demands Northern Ireland should stay in the bloc’s customs union. The call between the leaders, at 8 a.m. Tuesday, came after a text message from one of the prime minister’s officials, reported by the Spectator magazine, said his government is preparing for talks to collapse.

Elsewhere, the lira was poised for its first advance in three days, clawing back some of Monday’s losses, which were fueled by concern Turkey’s planned incursion into Syria will deepen a rift between Washington and Ankara. The Turkish Defense Ministry said all preparations are complete for the military operation into Syria, while reports stated that US does not endorse any Turkish operations in northern Syria, according to a senior administration officials who added that US troops will be withdrawn from the Turkey-Syria border, not out of Syria entirely.

Looking ahead, markets will be keenly watching comments from U.S. Federal Reserve Chairman Jerome Powell later in the day, who’s speaking at the annual meeting of the National Association for Business Economics, after some weak U.S. data last week raised concerns the U.S. economy may be heading towards a protracted slowdown. Other central bank speakers include the Fed’s Evans and Kashkari. There’ll be September’s PPI reading and the NFIB small business optimism index, while from Canada there’s September housing starts and August building permits. Expected data include PPI. Helen of Troy is reporting earnings.

Market Snapshot

- S&P 500 futures down 0.5% to 2,916.50

- STOXX Europe 600 down 0.2% to 382.04

- MXAP up 0.6% to 156.40

- MXAPJ up 0.6% to 500.32

- Nikkei up 1% to 21,587.78

- Topix up 0.9% to 1,586.50

- Hang Seng Index up 0.3% to 25,893.40

- Shanghai Composite up 0.3% to 2,913.57

- Sensex down 0.4% to 37,531.98

- Australia S&P/ASX 200 up 0.5% to 6,593.43

- Kospi up 1.2% to 2,046.25

- German 10Y yield fell 0.4 bps to -0.579%

- Euro up 0.2% to $1.0987

- Italian 10Y yield rose 1.9 bps to 0.512%

- Spanish 10Y yield fell 0.5 bps to 0.132%

- Brent futures little changed at $58.36/bbl

- Gold spot up 0.3% to $1,498.34

- U.S. Dollar Index down 0.1% to 98.90

Top Headline News from Bloomberg

- China signaled it would hit back after the Trump administration placed eight of the country’s technology giants on a blacklist over alleged human rights violations. Asked on Tuesday if China would retaliate over the blacklist, foreign ministry spokesman Geng Shuang told reporters “stay tuned.”

- Boris Johnson told German Chancellor Angela Merkel a Brexit deal is “essentially impossible” if the EU demands Northern Ireland should stay in the bloc’s customs union. The call between the leaders, at 8 a.m. Tuesday, came after a text message from one of the prime minister’s officials, reported by the Spectator magazine, said his government is preparing for talks to collapse.

- China’s state TV network CCTV said Tuesday that it would halt broadcasts of the National Basketball Association’s games as a backlash intensified against the U.S. league over a tweet that expressed support for Hong Kong’s pro-democracy protesters.

- The U.K. government revamped the tariffs it will levy after a no-deal Brexit following warnings from industry that its earlier plans risked making domestic producers uncompetitive.

- German industrial production unexpectedly improved in August after two months of decline, a development that will do little to alleviate concerns about intensifying trade tensions and waning business confidence.

- Japanese investors sold a record amount of Spanish bonds in August, seeking to lock in profits from five months of purchases while pivoting more toward U.S. debt.

Asian equities traded higher across the board despite a lacklustre handover from Wall Street where stocks were choppy but ultimately closed in the red amid trade war jitters after the US blacklisted Chinese governmental and commercial organisations over treatment of the Muslim minority community. ASX 200 (+0.4%) was kept afloat by miners amid favourable price action in base metals, whilst Nikkei 225 (+1.0%) was bolstered on the back of a weaker Yen and after US and Japan signed a limited trade deal on agricultural and digital trade. Hang Seng (+0.2%) and Shanghai Comp (+0.3%) returned from a long weekend and played catchup to the NFP-induced upside in the prior session. The former was buoyed by heavyweights Geely Auto after dealers noted a pickup in sales during Golden Week, whilst HKEX shares rose in excess of 2% after it dropped its GBP 32bln bid for LSE, as the boards of the two companies were “unable to engage”. Meanwhile, Mainland China saw upside despite the Caixin Services metric falling short of forecasts, as an improvement in the Composite metric signalled the strongest rate of growth since April. Furthermore, South Korea’s KOSPI (+0.8%) showed a strong performance as the index was supported by tech giant Samsung Electronics, who’s shares spiked higher by 1% after its Q3 guidance topped analyst expectations, albeit it still noted that its profits will likely plunge 56% Y/Y. Finally, core fixed-income futures drifted lower and tracked the risk sentiment around the market with UST and Bund futures poised to close Asia trade near session lows.

Top Asian News

- Hillhouse-Backed Genor Said to Seek Up to $1 Billion Valuation

- Samsung Billionaire Heir to Cede Board Seat Before Legal Probe

Major European Bourses (Euro Stoxx 50 -0.9%) are lower, with the region shrugging off a positive AsiaPac hand over, as trade jitters return to the forefront following the flurry of headlines yesterday evening. This morning, China’s Ministry of Commerce said to stay tuned for a blacklist retaliation to the recent US decision to list 28 Chinese governmental and commercial organisations, including Hikvision, to the entity list over treatment of the Muslim Uighur community. Further contributing to the downbeat tone, SCMP reported that China is toning down expectations head of US/China trade talks, and even though the round of talks will take place this week, a source says that the Chinese delegation is already planning to cut short its stay in Washington by one night. Moreover, Chinese negotiator Liu He will not carry the title of “special envoy” for President Xi Jinping at the meeting, which the article speculated is an early indication that the vice-premier has not been given any particular instructions from China’s leader. Separately, but also contributing some downside to global equities, was a return of no deal Brexit fears, with UK/EU talks seemingly approaching collapse and the UK government vowed to pursue a no deal exit unless the EU compromises. The confluence of negatives saw DAX Dec’ 19 futures lose the 12000 handle. Moving forward, further impetus likely to come in the form of Fed speak (including Powell at 19.30 BST) and Minutes tomorrow and US/China trade talks, US CPI and ECB Minutes on Thursday. Sectors are lower apart from Telecoms (unch.). In terms of individual movers; Airbus (+0.7%) shares were supported by a strong delivery update. Wirecard (-2.8%) initially moved higher after the Co. announced an increase to its Vision 2025 targets, before paring gains alongside the market. EasyJet (-6.3%) shares fell after a trading update; on the face of it the update appeared strong, however investors noted that they had been expecting firmer guidance, while also suggesting that the co.’s decision to not to have a conference call was a mistake. London Stock Exchange (-4.8%) sunk on news that the Hong Kong Exchange and Clearing will no longer proceed with their offer for the Co. Uniper (-8.2%) shares fell and Fortum (-0.2%) initially rose after the former announced it had agreed to acquire a majority stake in the latter, before falling with the market.

Top European News

- Fortum Gets Uniper Control in $2.5 Billion Deal With Funds

- U.K. Tweaks No-Deal Brexit Tariffs for Trucks, Fuel and Clothing

- Johnson Warned Against Big Tax Cuts as U.K. Faces No- Deal Shock

- German Factories Feed Unexpected Rebound in Industrial Output

In FX, NZD/AUD/SEK/TRY – Not quite all change, but certainly some solace for the Kiwi, Aussie, Swedish Crown and Turkish Lira following a bad start to the week. Nzd/Usd has regained 0.6300+ status on the back of supportive fiscal impulses as the NZ Finance Minister flagged a 4 bn budget surplus overshoot against target overnight, while Aud/Usd is hovering above 0.6750 in wake of mixed Chinese Caixin PMIs and an uptick in NAB business conditions. Elsewhere, Eur/Sek has eased back from 10.8900+ peaks towards 10.8500 with the aid of some encouraging Swedish data (private/services production and Usd/Try retreated from around 5.8450 to sub-5.8000 at one stage after US President Trump threatened to decimate the Turkish economy if it crosses the line in Northern Syria.

- GBP – In stark contrast to all the above, no deal Brexit risk has put the Pound back on the rack amidst reports that German Chancellor Merkel deems that a breakthrough on the Irish backstop is now highly unlikely, while other headlines contend that an agreement may be dead in the water full stop. In response, Cable lost grip of the 1.2300 handle and filled bids at 1.2275 before ploughing through more between 1.2260-50 on the way through 1.2230, while Eur/Gbp spiked to just over 0.8980 and beyond 500 mn option expiries at 0.8965.

- CHF/EUR/JPY – All firmer against the Dollar even though the DXY nudged back over 99.000 ahead of US PPI and Fed Chair Powell, with an element of underlying safe-haven demand underpinning the Franc, Yen and Euro awaiting US-China trade talks alongside the aforementioned Brexit negotiations on the cusp of collapsing. Usd/Chf is closer to 0.9900, Eur/Usd near the top end of a 1.0965-95 band and Usd/Jpy eyeing 107.00 again from circa 107.45 earlier. Note, latest SCMP reports confirms earlier talk that Beijing is not looking for any major deal and propose to cut their stay short, with Liu He not attending in the guise of special envoy that would imply no remit or agenda to sign off on a full trade agreement.

- NOK/CAD – The Norwegian Krona and Loonie are both holding relatively steady around 10.0400 vs the single currency and 1.3300 vs the Greenback respectively, with the former largely taking comments from Norges Bank Governor Olsen in stride as he underlined guidance for rates to remain on hold after September’s hike, barring the option to reverse the tightening move if economic developments deteriorated significantly. Meanwhile, Canadian housing starts and building permits are due and may provide the Cad with some independent direction or at least a distraction.

In commodities, the crude complex is lower on Tuesday, after negative news flow on the US/China trade and Brexit front spurring risk off. WTI Nov’19 futures broke below yesterday’s USD 52.60/bbl lows and technicians will now be eyeing support just ahead of the USD 52.00/bbl handle. Meanwhile, Brent Nov’ 19 futures are probing support at USD 58.00/bbl. In terms of geopolitical developments, news flow still appears focussed on the US’ recent decision to pull troops out of Northern Syria, which opens the door for a Turkish offensive against Kurdish forces in the area (reports allege the offensive had already begun), rather than on the US/Iran/Saudi picture; given Syria’s lack of oil it remains unlikely that these developments will have much of a baring on crude prices. In supply news, the North Sea’s Buzzard Oilfield remains closed, according to its operator, and there is still no timeline for its return to normal operations. Gold prices have reclaimed the USD 1500/oz mark assisted by the aforementioned trade and Brexit jitters, after reports that China is ready to do a deal on the parts of the negotiations both sides agree upon (and is prepared to set out a timetable for the harder issues to be worked out next year) triggered a lurch lower during US hours on Monday. Copper prices saw upside overnight on decent Chinese Caixin PMI data helped to moderate concerns about an economic slowdown in the country, but has since given up the majority of its overnight gains.

US Event Calendar

- Oct. 8-Oct. 11: Monthly Budget Statement, est. $96.5b, prior $119.1b

- 8:30am: PPI Final Demand MoM, est. 0.1%, prior 0.1%;

- PPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%

- PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.4%

- 8:30am: PPI Final Demand YoY, est. 1.8%, prior 1.8%

- PPI Ex Food and Energy YoY, est. 2.3%, prior 2.3%

- PPI Ex Food, Energy, Trade YoY, prior 1.9%

DB’s Jim Reid concludes the overnight wrap

I’m in need of motivational words from readers this morning. 5 months ago I set off on a journey of betterment and fulfilment but over the last few days I’ve had a wobble, become disillusioned and now need reassurance that I’ve picked the right path. Yes at 45, with three young kids, a full time (demanding) job and numerous other claims on my time I decided to completely remodel my 35 year old golf swing. After starting this process as a 5-handicapper back in early May, yet another poor round this past weekend has seen me move up to 7. Every time I tee the ball up at the moment I’ve got no idea how wild it’s going to be. Most evenings I stand in front of a mirror and do 30-40 minutes of practise swings before videoing it at the end to see the progress. My wife thinks I’m crazy. On camera it’s looking pretty good but on the course I’ve been struggling for months and have given myself tennis elbow for good measure with all the swinging. Oh and I’ve even moved to live opposite my golf course to try to find time to get better. So if you’ve made a big effort to try to get better at something and have experienced big lows before eventually seeing a euphoric payoff then I’ll be delighted to hear from you as I need it to motivate myself through the upcoming winter months.

US markets flipped between gains and losses yesterday with a level of direction normally reserved for my driver. We eventually closed in the light rough. In more detail the S&P 500 had initially opened -0.55% lower as investors first reacted to the Sunday night Bloomberg story that Chinese officials have become more reluctant to agree a broad trade deal. It then bounced back into the green to trade as high as +0.25% on comments from US official Larry Kudlow that we’ll discuss below. Ultimately the index fell back during afternoon trading to end -0.45% lower, though trading volumes were their thinnest in over a month. The NASDAQ (-0.33%) and the Dow Jones (-0.36%) performed similarly. While most of what Kudlow said was non-committal, saying that he didn’t want to predict the outcome of the trade talks, he did say that delisting Chinese companies “is not on the table”. We also got a White House statement yesterday that the US would be welcoming a Chinese delegation led by Vice Premier Liu He for further trade talks beginning on Thursday. The statement said that the topics of discussion include “forced technology transfer, intellectual property rights, services, non-tariff barriers, agriculture, and enforcement.” After markets had closed, news broke that the US is sanctioning eight additional technology companies over their involvement with China’s treatment and surveillance of the Uighur minority group. Coming just before the trade talks are set to begin, the announcement might lead to more tensions.

This morning in Asia markets have risen in spite of the above blacklisting news. The advances are across the board, with the Nikkei (+1.03%), the Hang Seng (+1.08%), and the Kospi (+0.97%) all trading higher, while the Shanghai Comp (+0.84%) also saw similar moves in spite of opening again after a seven-day public holiday. In corporate news overnight, Samsung’s results beat analysts’ estimates, even as operating profit fell 53% last quarter, and the company’s shares are up +1.36% this morning. We’ve also heard that Hong Kong Exchanges & Clearing are not going to go ahead with its attempt to take over the London Stock Exchange. Elsewhere 10yr JGBS are up +2.0bps this morning and S&P 500 futures are up +0.37%.

Back to trade, and in a special report yesterday (link here ), Peter Hooper and Michael Spencer looked at the current trade war with a historical perspective, as well as prospects for the future. They write that we’ve come to the end of a six-decade surge in global trade as a share of GDP, and that this growth led to a protectionist backlash because the benefits of trade were skewed increasingly away from lower and middle income households. Looking forward, they don’t expect the scope for trade conflict to change greatly after next year’s elections, regardless of the outcome, and either a Trump win or a progressive Democratic win could increase the intensity of the trade conflict in 2021.

Outside of trade, fiscal is another topical issue at the moment and there were interesting headlines on this yesterday from a European Commission document. It suggested that the “Euro-zone need pre-emptive fiscal stimulus to avoid protracted period of low growth” and that “more monetary easing now would be less effective than fiscal stimulus”. The Reuters article suggests that the document will be presented to the Eurogroup meeting of finance ministers next week. It’ll be interesting to see whether it gets traction but it’s important as it shows that the commission is starting to give Governments the green light to open the fiscal vaults. On page 44 of our long term study ( link ) we showed that monetary (QE especially) and fiscal policy have mostly gone in opposite directions since 2010. When central banks have been expanding their balance sheet, governments have been reducing their deficits and visa-versa. So the two moving in the same direction would be more powerful.

Back to markets yesterday and the other big move came from oil, which took a similar roundtrip move as stocks did. WTI and Brent had traded as much as +2.37% and +2.24%, which would’ve been the biggest move since the Saudi drone attack 3 weeks ago, but they retraced to end closer to flat as the risk-off mood reasserted during the afternoon. Nevertheless, energy stocks had led equity gains in Europe, with the STOXX Oil & Gas index up +0.99%, since they closed before the afternoon selloff. In the US, energy stocks lagged and the only group which advanced on the day was the safe-haven communications sector.

Unlike the US, European equities pared back losses to close higher yesterday, with the STOXX 600 up +0.71%, along with the DAX (+0.70%) and the CAC 40 (+0.61%). This was in spite of more negative data, once again from German manufacturing. Factory orders fell by -0.6% mom in August, (vs. -0.3% expected), bringing the yoy rate down to -6.7% (vs. -6.4% expected). This means that the yoy rate has been negative for 15 consecutive months, and comes at a tense time for the German economy, which stands on the brink of a technical recession after contracting by -0.1% in Q2. In the US, 10yr Treasuries ended the session +3.1bps, although the curve flattened with the 2s10s -2.7bps at 9.3bps.

It was the reverse picture in sovereign bond markets, which pared back gains to end the session lower, with ten-year bunds (+1.3bps), OATs (+1.0bps) and BTPs (+1.9bps) all seeing higher yields. The outperformance came from Portugal yesterday, where government bonds outperformed following the country’s election results, with ten-year yields down -0.4bps as investors looked for continuity as Prime Minister Costa increased his Socialist Party’s representation in parliament. Costa is still short of an overall majority however, so needs to work out an alliance with other parties, and has said he wanted to continue working with the Left Bloc and the Communists as he has for the last four years. Costa’s target is to bring public debt down from 122% at present to below 100% of GDP by the end of this four-year term in 2023. Portuguese 10yr yields fell below their Spanish equivalents for the first time since December 2009 with yields falling to 0.137% – impressive given that they were at 4.297% as recently as 2017, and as high as 17.393% in the sovereign crisis in 2012.

Elsewhere in the world of Sovereign risk, the Turkish lira fell -2.47% against the dollar yesterday, its worst session in over six months, extending losses after President Trump tweeted that “if Turkey does anything that I, in my great and unmatched wisdom, consider to be off limits, I will totally destroy and obliterate the Economy of Turkey”.

In terms of the latest on Brexit, Prime Minister Johnson won a Scottish legal challenge yesterday, where anti-Brexit campaigners had sought to force Johnson into sending the extension required under the Benn Act. The judge said that the “unequivocal assurances” that he would obey the law were sufficient. After today’s proceedings in Westminster, Parliament will be prorogued again later on today. However unlike the last prorogation, which ended up being ruled unlawful by the Supreme Court, this one is only until a Queen’s Speech on Monday, which is where the UK government outlines its legislative programme for the coming parliamentary session. Meanwhile, there seemed to be little progress towards a deal ahead of the crucial EU Council meeting on 17 October, and last night the Spectator magazine published what they claim was a message from someone in Prime Minister Johnson’s office that the government were preparing for the talks to collapse and that as a result they would be forced into fighting the next election explicitly on a no-deal platform to ensure they carried the leave vote with them.

Turning to the day ahead, we have a number of highlights, including remarks from Fed Chair Powell, who’s speaking at the annual meeting of the National Association for Business Economics. In terms of other central bank speakers we’ll hear from the BoE’s Haldane and Tenreyro, the ECB’s Lane and Hernandez de Cos, along with the Fed’s Evans and Kashkari. The data picks up a little as well this morning, with August releases for German industrial production, Italian retail sales and the French trade balance. From the US, there’ll be September’s PPI reading and the NFIB small business optimism index, while from Canada there’s September housing starts and August building permits.

0 Comments