In a week in which the Federal Reserve had to cut interest rates by 25 basis points, signaling to the financial markets that all may not be so good in the global economy.

Both silver and gold spot price markets held strong even with a brief derivative selloff Wednesday when the Federal Reserve announced its interest rate cut.

The silver spot price is finishing the week down, about two cupronickel dimes, closing around $16.25 oz.

The gold spot price is closed the week on a strong note near $1,445 oz.

The GSR rose due to gold’s outperformance versus silver this week. It still costs around 89 ounces of derivative silver to equate to one ounce of the gold spot price’s fiat US dollar value.

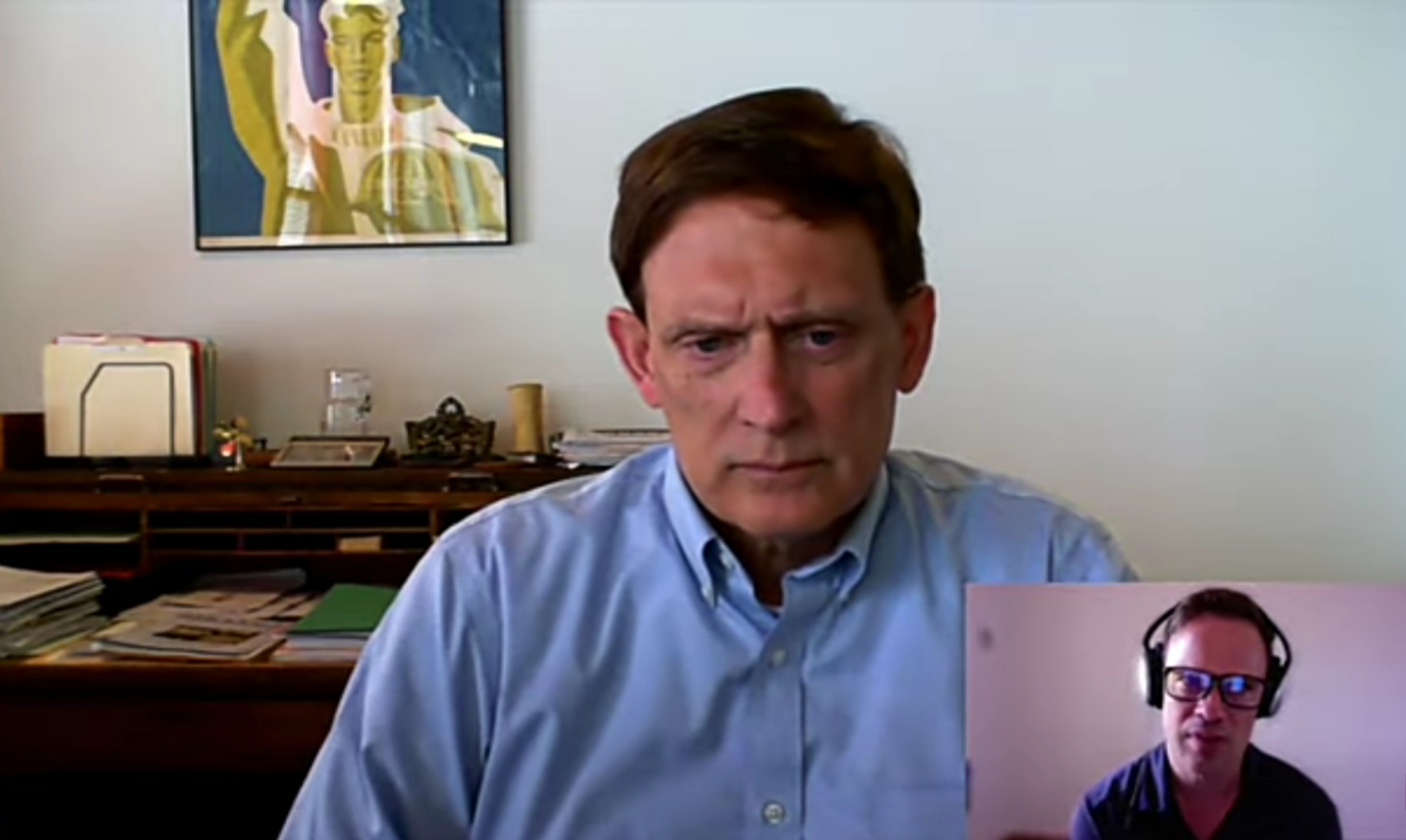

This past Wednesday before the Federal Reserve cut interest rates, I had the pleasure of speaking with Jeffrey Christian of CPM Group about a whole host of topics.

We cover what in his experience are the critical ingredients for silver bullion bull markets of the past and potential future.

We also go back in time as Jeffrey recollects his experience as a journalist covering the Hunt Brothers in the late 1970s commodity bull markets.

0 Comments