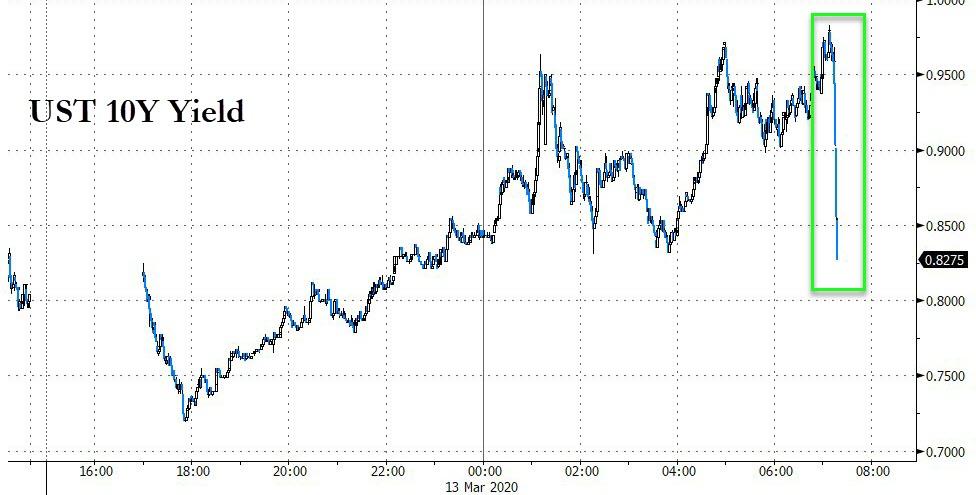

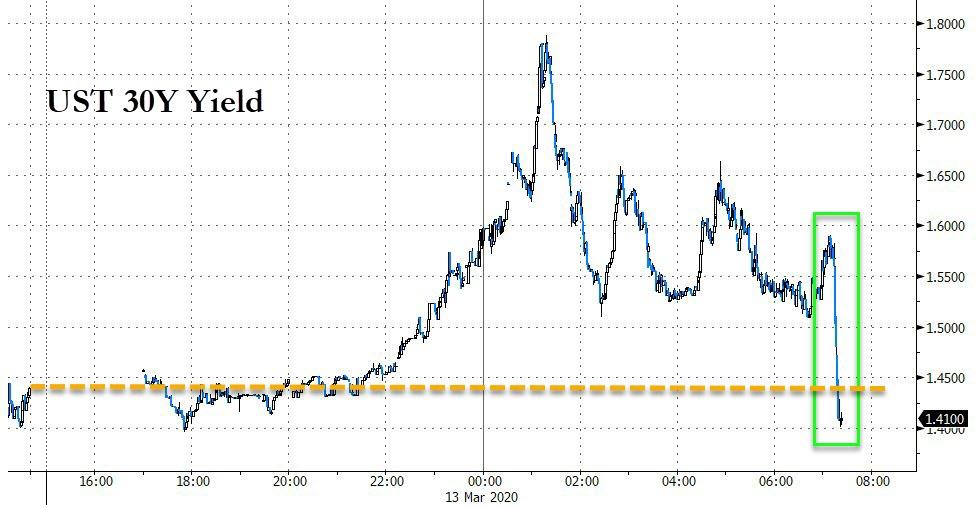

US Treasury yields are plunging after The Fed announced what amounts to ‘Emergency QE’ to buy $33 billion in bonds at maturities up to 30 Years…

10Y yields have plunged 16bps on the headline…

And 30Y yields are now down 3bps on the day, after being up 35bps overnight…

The Desk will conduct purchases in each of five maturity sectors below at the times indicated, subject to reasonable prices.

- 20 to 30 year sector at 10:30 – 10:45 am and 2:15 to 2:45 pm for around $4 billion each

- 7 to 20 year sector at 11:15 – 11:30 am for around $5 billion

- 4.5 to 7 year sector at 12:00 – 12:15 pm for around $8 billion

- 2.25 to 4.5 year sector at 12:45 – 1:00 pm for around $8 billion

- 0 to 2.25 year sector at 1:30 – 1:45 pm for around $8 billion

These purchases are intended to address highly unusual disruptions in the market for Treasury securities associated with the coronavirus outbreak. These purchases are part of the $80 billion of planned monthly purchases, including both $60 billion of reserve management purchases and $20 billion of reinvestments of principal payments received from the Federal Reserve’s holdings of agency debt and agency mortgage-backed securities.

Article written by Tyler Durden for Zero Hedge

0 Comments