I can’t count the number of different theories I’ve been presented by market experts about gold. Invariably, no matter how sophisticated the theory is it always boils down to, “dollar up, gold down,” and vice versa. And this usually is said with the kind of frank smugness that is a prelude to someone going broke.

During normally functioning markets they are usually right. But in this day of central bank risk-suppression and price controls can we really define when or how markets are functioning normally?

Because if this week is any indication, all conventional wisdom about gold should be discounted by about the same amount that the market is Lebanese sovereign debt right now.

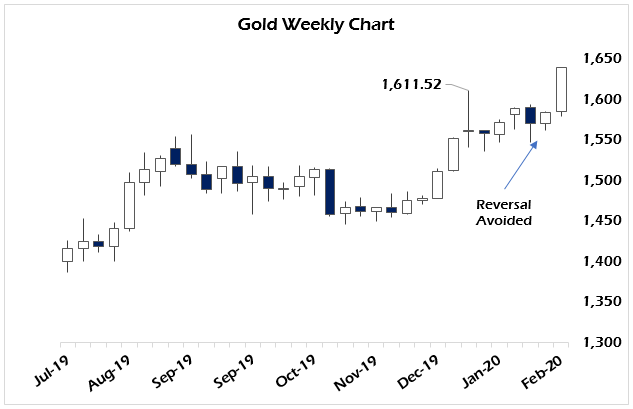

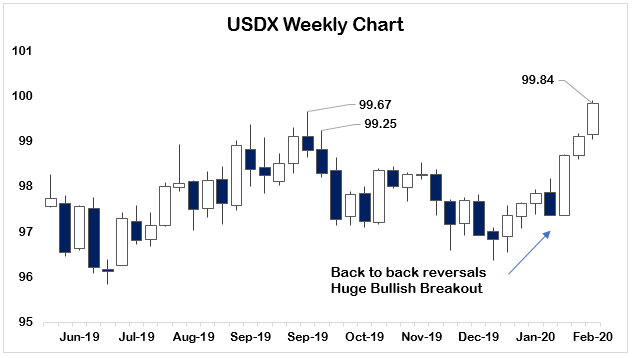

Because if gold is the inverse of the dollar under all circumstances, then how do you explain a week in which gold breaks to a seven-year high near $1,650 with nary a pause at the January high while the USDX simultaneously breaks out into a new trading range to the upside?

Human interpretations are faulty, we see what we want to see in all things. And so many will dismiss this week as an anomaly. But charts don’t lie when you look at them without adornment.

Since the beginning of 2020, gold and the dollar have been in lockstep moving higher together. It would be one thing if, for example, it was a relief rally in gold after an extended or overdone downtrend.

But that’s not what’s going on here.

This is a fear trade, folks. Plain and simple. And it’s a reflection of the uneasiness in global markets as a result of a lot more than just the news coming out of China about the coronavirus. That is just another stressor, the proverbial straw on the camel’s back that finally broke down official price suppression through central bank liquidity injections and interventions into the repo markets.

by Tom Luongo for Money and Markets

RTD 1oz. Round

RTD 5oz. Round

0 Comments