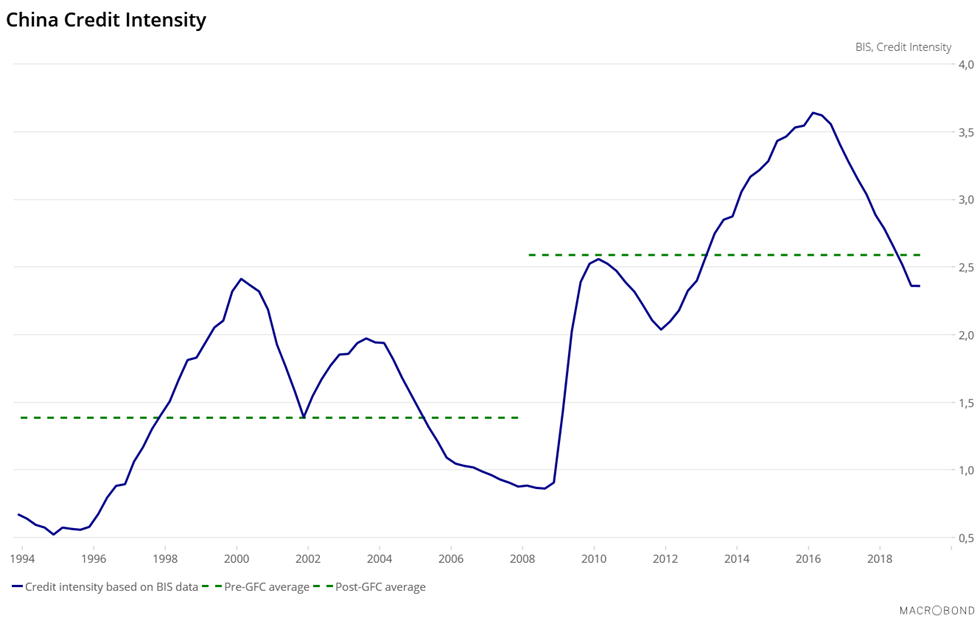

One week ago, we showed in one chart why the global economic recovery that so many expect is just a few months away, won’t happen: as the chart below shows, China’s credit intensity since 1994 has exploded. This means that before the Global Financial Crisis, China needed on average one unit of credit to create one unit of GDP.

Since 2008, 2½ units of credit are required to create one unit of GDP. In other words, that China needs much more credit than 10 years ago to have the exact same amount of GDP. Injecting more credit in the economy is not the miracle solution it used to be, and the disadvantages of credit push tend to surpass the advantages.

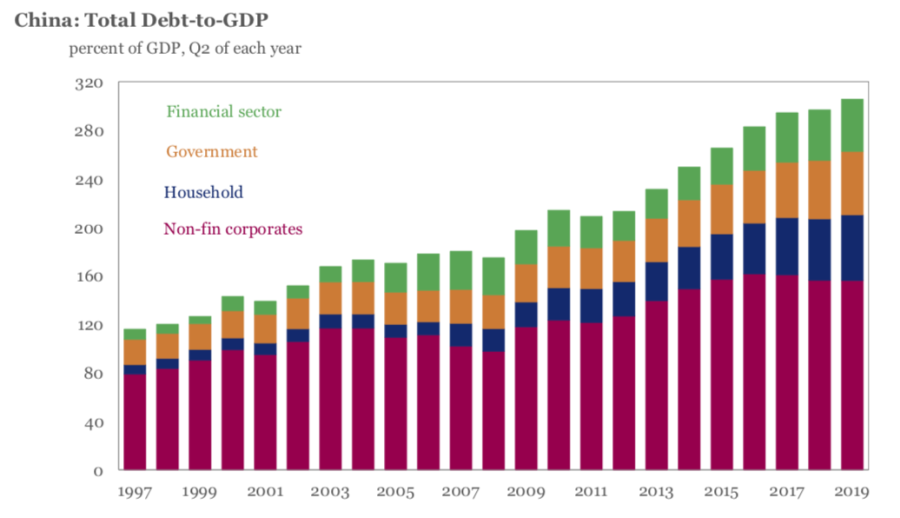

This explosion in China’s credit intensity in the past decade has directly fueled China’s debt engine, the same debt engine that single-handedly pulled the world out of a global depression in 2008/2009. Alas, this will not happen again: China’s public and household debts are at their highest historical levels, respectively at 51% of GDP and 53% of GDP, and the private sector debt service ratio is becoming a burden for many companies, reaching on average 19.7% This records an increase from 13% before the crisis. Overall, China’s debt to GDP is fast approaching an unprecedented 320%!

Which brings us to Saxo’s dour conclusion for all those who believe that the global economy is about to enjoy another period of sustainable growth (and has confused the Fed’s QE for economic resilience and fundamentals):

Contrary to previous periods of slowdown, notably in 2008-2010, 2012-2014 and in 2016, China is unlikely to save the global economy once again.

So what does it all mean? Well, even as domestic demands for liquidity are growing, foreign capital keeps flowing in and the real economy continues to slow down, which all make the country seemingly approaching a zero rates monetary condition.

While those words succinctly summarize what we said last week, they originate in an English language op-ed published today in China’s nationalist tabloid, Global Times, which for once, is surprisingly accurate, and while mostly avoiding the propaganda that Chinese media is so well known for, explains well why China may indeed be the next country to see zero rates (as a reminder, Chinese real rates are already negative due to soaring pork prices).

And while we doubt that the PBOC will be able to cut enough to bring about ZIRP, or NIRP, any time soon especially due to the ongoing hyperinflation in pork prices, if and when those do stabilize the Chinese central bank may well follow in the footsteps of every other developed central bank. In doing so, it will only infuriate Trump who has been kicking and screaming at Jerome Powell, demanding that the Fed do just that.

What we find most remarkable about the op-ed is how simply, matter-of-factly and correctly, the author explains away why zero rates are coming:

Mounting debts and the financing problems in the real economy will promote China to a zero rate condition

…

Structurally, China’s non-financial corporate debt ratio is too high, and interest rates are too high. Considering that the repayment burden of existing debt has squeezed out the effective demand for new credit, and China is likely to become the next zero interest rate country

Amusingly, the anonymous op-ed writer has managed to state in two sentences what takes financial pundits hours, days and weeks to explain on CNBC:

Another phenomenon comes with low rates monetary condition is that prices go up with risk asset. The US stock prices have climbed to a new high.

That said, what we found most surprising about the Global Times oped is its conclusion: instead of some jingoist bullshit about how China’s negative rates would be the greatest, and most negative in the entire world, the publication takes a very measured tone, and warns that such a monetary stance may very well spell doom for China, to wit:

Zero or negative rates monetary conditions don’t mean that debt issues and the asset bubble problem will be resolved automatically, but the opposite. Growing bubbles in the global financial market in the long run will be a reminder of financial risks.

In a slowing global economy, zero or even negative interest monetary conditions are a new trend that gives new risks and challenges to China and the international financial market. Awareness and responsiveness need to be revamped.

Of course, by the time China is approaching ZIRP, the trade war between the US and China will be at such a heated, if not outright “kinetic” level, that few will notice or care what Beijing’s monetary policy is.

We strongly urge all US policymakers to read the following Global Times article, which is nothing short of a trial balloon warning what China is contemplating next in a desperate move to stimulate its economy, no matter the cost.

China needs to prepare for zero interest rates

The US Federal Reserve’s (Fed) continuous interest rates cuts have triggered a race of interest rates cuts among central banks around the world, increasing excessive global liquidity even further. In this case, more countries are faced with monetary conditions of zero or negative rates. Recently, former US Fed chairman Alan Greenspan noted that “negative rates” are spreading around the world. Some financial institutions even believe the world will enter a low rates condition that hasn’t occurred in 1,000 years.

Under the condition of low or zero rates, the world’s debts level keeps rising, and the bond yields continue dropping. Another phenomenon comes with low rates monetary condition is that prices go up with risk asset. The US stock prices have climbed to a new high.

For China, the demands for liquidity are growing, foreign capital keeps flowing in and the real economy continues to slow down, which all make the country seemingly approaching a zero rates monetary condition. It asks policymakers and market players to be prepared. Mounting debts and the financing problems in the real economy will promote China to a zero rate condition. In the first half of 2019, China’s overall debts accounted for 306 percent of the GDP, up 2 percentage points from the 304 percent in the first quarter, according to a report from the Institute of International Finance (IIF). The number was just around 200 percent in 2009 and 130 percent in 1999.

According to data from the National Institution for Finance and Development, China’s enterprise sector’s debts account for 155.7 percent of the nominal GDP, up 2.2 percentage points from the end of last year. It’s far beyond the government sector’s leverage ratio of 38.5 percent and the resident sector’s leverage ratio of 55.3 percent. In the enterprise sector, private companies embattled with financing problems account for 30 percent.

Structurally, China’s non-financial corporate debt ratio is too high, and interest rates are too high. Considering that the repayment burden of existing debt has squeezed out the effective demand for new credit, and China is likely to become the next zero interest rate country, according to Zhu Haibin, Chief China Economist at J.P. Morgan.

The low rates or zero rates condition will in turn reduce the effect of current monetary policy tools. In the overall picture of global interest cuts, the low inflation level causes monetary policy to face challenges. In China, the problem is severe. Currently, China is facing the superposition structural consumption of inflation and production deflation, which is squeezing the space for monetary policy adjustments. Both targeted and “flood-like” stimulus can’t overturn the economic slowdown. New monetary tools and new aims are urgently needed in the zero rates monetary condition.

In the real economy, the zero rates monetary condition will highlight structural problems. The drop of interest rates doesn’t necessarily lead to investment increases. The stratification in liquidity and credit will remain under overproduction conditions and bring new problems to small and medium-sized enterprises. The enterprise sector needs to more urgently prepare for upgrades and maintain competitiveness. The zero rates monetary condition also asks for promotion in supply side reforms, and to resolve problems in the monetary transmission mechanism.

In the finance sector and capital market, the zero rates monetary condition is also challenging for the banking industry and shadow banking. On one hand, dropping interests will narrow the profit space for banks, pressing their performance. On the other hand, enterprises which take loans as main financing means still face structural credit risks that banks can’t identify. It asks banks to build up management and capital capacity to deal with tougher competition. Zero rates will make more investors turn to direct financing, which causes new challenges in evaluation, pricing, investment modeling and investment portfolio balance. It also requires strengthening investment market building, and providing a level playing field.

Zero or negative rates monetary conditions don’t mean that debt issues and the asset bubble problem will be resolved automatically, but the opposite. Growing bubbles in the global financial market in the long run will be a reminder of financial risks.

In a slowing global economy, zero or even negative interest monetary conditions are a new trend that gives new risks and challenges to China and the international financial market. Awareness and responsiveness need to be revamped.

The article was compiled based on a report by Beijing-based private strategic think tank Anbound. [email protected]

0 Comments