Brazil, Russia, India, China and South Africa, or the BRICS economic bloc, are engaging in discussions to issue cross-national digital money in order to reduce the dependence of their economies on the United States, as reported by Cointelegraph on Nov. 14. What will the new cryptocurrency look like, how does the BRICS group plan to use it and are there any existing projects underway that seek to achieve a similar goal of independence on such a high level?

BRICS and its problems

BRICS is the largest geopolitical block of countries, spanning three continents and wielding substantial economic power in global affairs. As of 2018, the five nations of the BRICS block had a combined nominal gross domestic product of $40 trillion, or about 23.2% of the gross world product.

However, such economic power does not come without competitive penchants from other nations that are vying for the markets that BRICS nations cater to. The greatest competition comes from the European Union and the U.S.

The political experience of recent years has shown that BRICS countries’ diplomacy has arguably failed in alleviating international sanctions, especially in politically sensitive markets such as the arms and the energy carriers markets. However, advances in technology are here to help out where politics cannot, as blockchain and digital assets have the potential to open entirely new horizons for finance.

The idea of a single cryptocurrency as a means of payments and value transmission is not a new one, but it is one that is being actively purported not only in countries like Venezuela with its Petro, but also among BRICS countries. The advantages of a single cryptocurrency as a universal means of settlements among BRICS nations would solve many of the problems they face on the global economic market.

A means of circumventing U.S. sanctions

The BRICS Business Council discussed creating a common cryptocurrency as a potential solution to these problems during the 11th BRICS summit that was held in Brazil on Nov. 13–14, according to reports that cite Kirill Dmitriev, a member of the council. Dmitriev, who is the director-general of the Russian Direct Investment Fund, went on to say that an efficient BRICS payment system could be used to stimulate settlements between the countries while reducing the use of the U.S. dollar for these purposes.

It was also reported that the new system may become an alternative to the international payment mechanism SWIFT to facilitate trade with countries under U.S. sanctions.

Dmitriev also noted that in recent years, the share of U.S. dollars payments made between the BRICS countries has significantly decreased. In Russia, for example, over the past five years, the share of USD in foreign trade transactions fell from 92% to 50%, while those made in the Russian ruble rose from 3% to 14%.

At the same time, the potential for reducing the U.S. dollar’s dominance is still great, according to macroeconomic analyst Oleg Dushin, who told Russian media outlet BFM that such could be the case if Russia and India changed the currency they use to make payments between each other.

Dushin also said that Russia and China have already stopped using U.S. dollars in half of their mutual settlements and that there is currently a general trend of driving the dollar out of the international payments system. This, according to the expert, will help BRICS countries weaken the influence of the dollar in the global monetary system and reduce the risk of payments being frozen by Washington.

Denis Smirnov, a blockchain consultant from Russia, noted to BFM the convenience and reduction of transaction costs as some of the advantages of creating a single cryptocurrency system for the BRICS countries, calling it an alternative to bonds.

Commenting on the possibility of BRICS countries using a single cryptocurrency, Vladimir Rozhankovsky, an expert at the International Financial Center, told BFM:

“If it is possible to reduce currency risks, then it is better to carry out trading payments directly, and not through the purchase of dollars — this is obvious. The vast majority of more or less large global economies are now working on this issue.”

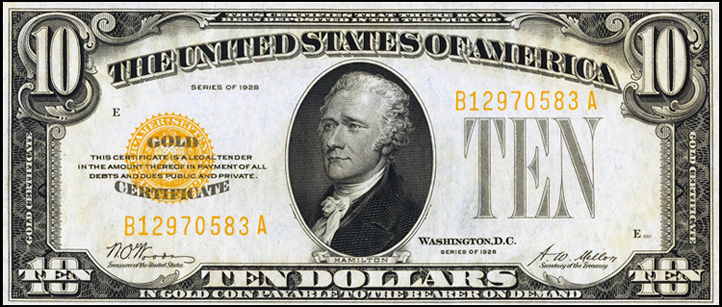

Peg to gold, not the U.S. dollar

While it is still unknown what the BRICS cryptocurrency will look like exactly, experts are discussing what it could potentially be tied to. Commenting on the possible options that the international cryptocurrency may be tied, Elina Sidorenko, the head of the Russian State Duma’s working group on cryptocurrency issues, said that there are several options on the table.

For example, it could be tied to the value of another cryptocurrency, she told Russian media outlet Dp, “but in this case, it’s impossible to avoid either the continuation of the U.S. dollar’s monopoly,” or it can be pegged to the price of a raw material or a good, but then the risk of market manipulation becomes a threat. She concluded:

“The thirasd option is a link to gold, and taking into account the latest Basel Accords, such a decision seems very convincing and timely.”

Olinga Taeed, a council member and expert advisor at the China E-Commerce Blockchain Committee, told Cointelegraph that the Chinese have been researching the possibility of issuing a gold-backed token due to the country’s access to natural mineral reserves in Africa through China’s Belt and Road Initiative. He went on to add:

“More recently frictionless international trade has come to the fore with DLT looked upon as a possible solution for Brexit for example, replacing the usual 5-10 year gestation period. So the thinking is well rehearsed but what is new here is the willingness to enact it and for evidence of this there is absolute clarity. Trump has made transparent the long established use of the financial instrument of the dollar to pressurise Iran, Russia, China, etc for non-financial gain.”

Russia seeks an alternative to SWIFT

Russia has been the target of sanctions since 2014. As a result of multiple economic restrictions, Russian authorities have been considering the possibility of creating alternatives to SWIFT.

One of them — the System for Transfer of Financial Messages, or SFPS — is reportedly being used in 18% of money transfers in the country, and foreign financial organizations began to join SPFS in 2018. However, in April, Russian Finance Minister Anton Siluanov noted that SPFS is not a full-fledged replacement for SWIFT and that it is unlikely to become one in the near future.

Now, the Russian government is considering another alternative: a national cryptocurrency secured by gold. Elvira Nabiullina, head of the Central Bank of Russia, said that such a currency could be used to carry out settlements with other countries for trade transactions. However, Nabiullina is also of the opinion that it is more important to develop international settlements facilitated by national currencies rather than crypto.

The sanctions had blocked at least 20% of Russia’s defense transactions in 2018 due their tether to the U.S. dollar. Though Russian authorities are gradually moving toward settlements in national currencies with BRICS states, the idea of a unified cryptocurrency is being openly discussed as an effective, transparent, untraceable and stable instrument for circumventing U.S. sanctions and decreasing dependence on the U.S. dollar.

BRICS states would be able to disregard any exchange rate differences in settlements in a single cryptocurrency, and Russia would gain solid support for its national currency — the ruble — which suffered a twofold drop in value.

China considering a national crypto to bypass U.S. sanctions

China is the leading nation of the BRICS bloc in terms of GDP and the most open nation when it comes to discussions about blockchain implementation. China is intent on accelerating the development of its own central bank-backed digital currency and is working toward the integration of blockchain technologies into other important financial mainstays of the country, such as Alibaba, Tencent and various banking institutions.

Such hasty development could in part be the result of a heated debates about Facebook’s Libra coin. Chinese analysts fear that the development of a global digital currency by a company, which is regarded to have strong affiliations with the U.S., would threaten the existence of national currencies and weaken their exchange rates. Such a stablecoin backed by the U.S. dollar may increase the power of its penetration into the global economy and thus solidify the political positions of Washington.

Chinese authorities are interested not only in the development of a unified cryptocurrency for settlements with BRICS countries but also in the launch of a national cryptocurrency that would serve as a shield against the economic adversary across the Pacific.

Brazil has a positive stance on using stablecoins

Brazil is demonstrating the highest rate of Bitcoin (BTC) trade in Latin America. Such broad penetration of digital assets in Brazil makes it both fertile ground for the development of a national cryptocurrency and firm ground to support for a unified BRICS cryptocurrency for settlements with member states.

Given the country’s positive stance toward blockchain, Brazilian authorities seem to be open to discussions with stablecoin issuers. One recent example is that of the Mile Unity Foundation, whose representatives met with members of Brazil’s Ministry of Industry, Foreign Trade and Services to discuss the use of the XDR stablecoin for international transfers of funds.

Given that Brazil had an export/import balance of $219 billion to $140 billion in 2017 alone, the potential for using a single cryptocurrency with BRICS member states for increasing such figures is immense.

Although Brazil does not suffer from sanctions, its main trade partners in technology, such as Russia, are subject to them. Using the U.S. dollar for mutual settlements between countries leaves little room to maneuver.

India is fighting with poverty and corruption

The Indian authorities are reportedly discussing the introduction of a national digital currency. There may be significant reasons for such a move, not the least of which being the alleviation of the poverty that many of the country’s 1.3 billion are languishing in.

The Reserve Bank of India is pushing for such a digital currency backed and regulated by the central bank as legal tender. The RBI hopes that blockchain can alleviate the issue with corruption, which is rampant in India, and significantly reduce the dependence of millions of Indians working abroad on financial intermediaries in cross-border transfers.

The Indian authorities are also proponents of a national digital currency for reducing the population’s reliance on other digital currencies. Given India’s stance within BRICS as a major buyer of Russian arms and as one of the most important energy trade partners, having mutual settlements in a unified digital currency would open up entirely new prospects for trading.

South Africa is making money transfers accessible for citizens

The possibility of issuing a national digital currency has even been discussed by the South African Reserve Bank, which could allow for its citizens to freely transact without the need for banks.

Given the staggering number of unbanked individuals (estimated to be around 11 million people) and those without any form of official IDs in the country, the availability of a national digital currency would help millions of citizens gain access to financial services and boost economic development. South Africa is just as bound to the U.S. dollar as all the other BRICS members in its settlements with China and Russia, meaning that is also feels the impact of the sanctions regime.

Experts say

According to experts, the idea of creating a digital currency for BRICS may turn out to be highly viable, given the transition of the world from a monopolar political model to a multipolar one and the backdrop of a shift in the economy from traditional financial institutions to trading platforms.

And the main beneficiary so far could be China, which is interested in expanding its sales markets amid a trade war with the U.S. Smirnov told BFM that he believes that over time, such systems will become more widespread:

“For example, for the past two or more years a consortium of several European banks has been testing its own mutual settlement solution that works outside the SWIFT system and allows for interbank settlements.”

The individual national currencies of the BRICS countries have been dropping against the U.S. dollar over the past 10–20 years, but it is unclear whether a unified BRICS payment system would reverse this trend. However, it is possible that the U.S. dollar could be weakened if the share of settlements in dollars significantly decreases around the world.

Among other possible risks that may be associated with the idea of issuing a gold-pegged international digital currency, head of research at investment company Nord Capital Vladimir Rojankovsky noted the deregulation of the market and the possibility of manipulation. He told Russian media outlet Regnum, “Such an implementation of this project does not imply the involvement of any distinguished party, which is a living oversight body.”

Speaking about the further development of the BRICS initiative, Teemo Puutio, an expert in compliance and an adjunct instructor at New York University School of Professional Services, told Cointelegraph:

“Whether the BRICS backed currency would ultimately succeed in gaining traction would largely depend whether it actually facilitates trade instead of adding another layer of technological complexity for the end user. […] BRICS are not alone in this however and it remains unclear whether the dominant digital currency of the future will be public such as the e-Euro or digital yuan or private, like Libra.”

Article appeared on Cointelegraph.com here….

I am a patreon member, and you sent a podcast to my email but I cant get it on my laptop or my phone. The title is “Wise Talk Mastermind ep3

Hello Carol. Please refresh the page and the link should work.