This is going to be a challenging week.

Coronavirus is the dominant feature, and its unknowable. As an exogenous shock its out-with-normal market experience. The speed at which it’s apparently taking hold in Italy is properly scaring the pants off the authorities across the Occident. The media can’t help itself fuelling fear. The vibe around the virus has become fervid! While the Daily Mail is saying we’re all going to die horribly, it’s unlikely anyone is going to pay attention to government advisors on the TV telling us;

“Relax, drink plenty of hot tea, take vitamin C and it’s all going to be fine if you just take simple precautions like washing your hands.”

Next few days, maybe weeks, are going to be driven by escalating fears of the unknown – to which markets are proving they are not immune. Don’t be in the least surprised to see a string of advisories about not travelling, don’t use the tubes, and locking yourself in tall dark towers. Nothing we can do about it except be Boy Scouts. Be prepared.

About half the staff here at Shard are working from home today to test the robustness of our systems and comms to make sure we can respond in a resilient fashion – whatever happens next. We prepare for bad, expect it to be OK, and hope it will turn out better than expected. Personally, I am not going to be using the tube for the next few weeks….

The reality is the virus, or more correctly, the response to the virus, is causing significant real economic damage – therefore market reactions are justifiable. Unfortunately, as always happens, Markets over-egg the downside. We are into a classic negative loop – some participants are still looking for feedback, but most players get to a stage where they start to wildly anticipate moves – panic first, consider later. The time for positioning was last week. This week… the best I can suggest is: enjoy the ride.. if you can.

The macro picture is clearly beginning to deteriorate on busted supply chain, production slowdowns, fears about corporate cashflow, and cascading consequences. The US jobs number on Friday was fine, that was for a US economy as yet largely untouched by the crisis through February. Other nations are showing clear strains. China exports crashed through Q1. They might be posting some minor signs of normalisation, but elsewhere the news is unremittingly bad – and likely to get worse.

The 30% weekend collapse in oil prices – largely a result of the Saudi / Russia breakdown – will certainly trigger fear this morning. It further hints at slowdown on crashing demand, but it will cause massive pain for US marginal shale producers. As the Alex Salmond trial gets underway in Edinburgh, I wonder how the SNP will sell Scottish financial independence as oil tests $27 a barrel. (The French might not be so keen to finance an independent Scotland anymore.. not after we crushed their Grand Slam on Sunday.)

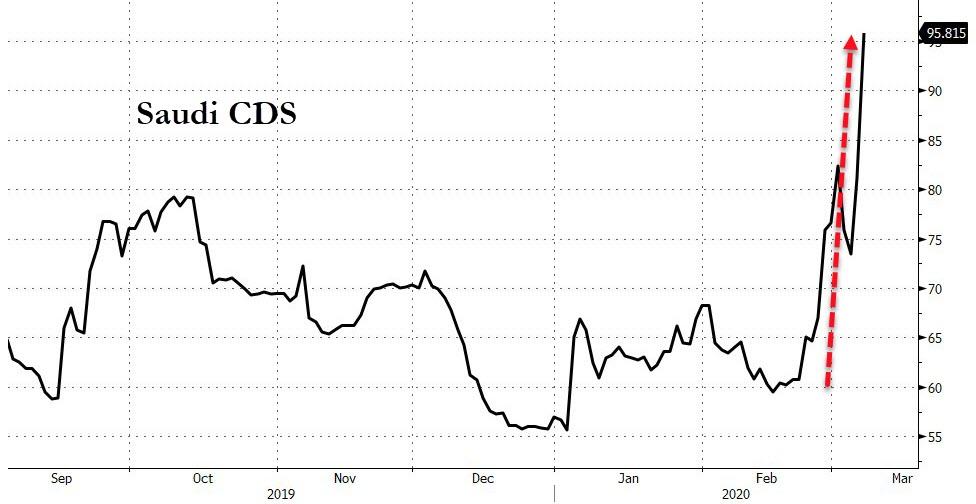

Crashing oil raises the threat level on Saudi – analysts are increasingly concerned what Crown Prince MBS’s increasingly despotic behaviour means for regional stability. Locking up his rival family members on trumped up Treason charges reads like a Shakespearian tragedy. Its unlikely low oil prices will prove an economic boost in this environment.

With the VIX back up in the big numbers (spiking to 54 on Friday), corporate bond markets going into lockdown – liquidity has dried up completely as lethargic investors suddenly awake from complacency and start to panic about the possibility of cascading corporate defaults into a recession– and stock markets look at the charts and worry if the markets can be supported around current levels, or are about to take a tumble down 20% to the next support levels, the vibe is all about “how low can we go”, rather than thinking about buying opportunities.

We are past the Buy The Dip moment. This is about something far deeper – but it’s always the right time to be thinking about what comes next.

No matter how bad the virus generated fears are – the sun will come up tomorrow. Tomorrow might not be till sometime in April or May, but as crisis will start to moderate (and the media gets bored with scaring us), the pressure will lesson. Markets will have priced in the effects.

The time to be looking for bargains is… all the time.

I’m looking! Solid investments with real cashflows that will remain valid even through a 2-3 month global viral lockdown. Sectors most likely to benefit from government support and bailout. Even aviation isn’t going to end forever over the next few weeks. Global shipping has never looked so cheap – maybe its time to look at cheap as chips containers? I can’t remain invested in zero rate government bonds for long, and you simply can’t eat gold… The trick will be as much knowing when to close Govt and Gold positions to buy corporate debt on the sly.

The big question will be stocks… not quite a reset moment, but certainly time to look at fundamentals and really understand growth stories.

Article written by Bill Blain for MorningPorridge.com

RTD 1oz. Round

RTD 5oz. Round

0 Comments