As households struggle to make ends meet, more Americans have been forced to halt or raid their retirement savings in this coronavirus-induced depression.

Nearly 3 in 10 people have decreased the amount of money they’re setting aside for retirement or stopped saving altogether due to the economic fallout of Covid-19, according to a FinanceBuzz survey published in August.

Around 30% of retirement savers tapped their retirement accounts over the last 60 days, according to a MagnifyMoney survey published in May. Those consumers pulled out $6,757, on average.

Just over half withdrew money in order to cover expenses and 26% did so because of a job loss, according to the survey, which polled 1,239 Americans with retirement accounts.

‘No question’

“There’s no question this is happening, and there’s no question what the reason is: loss of income and fear of loss of income,” said Stephen Brobeck, a senior fellow at the Consumer Federation of America, a consumer advocacy group.

“People think they may be laid off, they may lose hours, and they don’t have any short-term savings or an emergency fund, or it’s a very inadequate one,” Brobeck said.

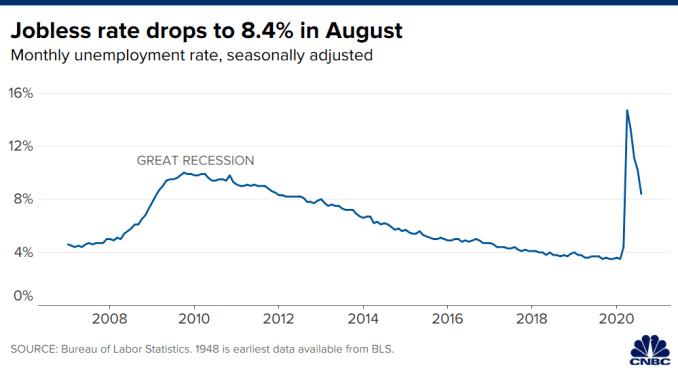

Unemployment exploded in the early weeks of the coronavirus pandemic to levels unseen since the Great Depression, as state officials shuttered broad swaths of the economy to contain the outbreak.

While the unemployment rate has recovered somewhat, to 8.4% in August, joblessness remains elevated compared with most recessions since World War II.

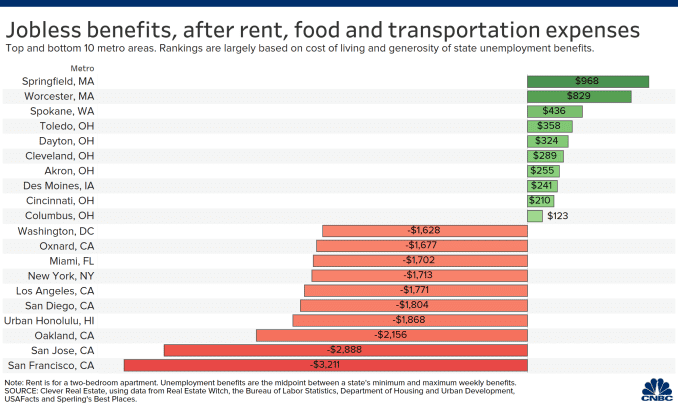

Meanwhile, a $600-a-week federal subsidy to unemployment benefits that had been propping up household spending, especially for lower earners, lapsed at the end of July. That left some with as little as $5 a week in state aid.

More than 134 million American adults reported having at least a little difficulty paying the usual household expenses over the last seven days, according to a U.S. Census Bureau survey conducted last month. A quarter — about 32 million — said it was “very difficult.”

Six months into the health and economic crisis, nearly 30 million people are still collecting unemployment benefits and more than 1 million file new applications for aid each week.

The number of Americans who’d prefer to work full-time but are forced to work part-time hours is also up by 3.3 million people versus February, according to the Bureau of Labor Statistics.

‘Two-track economy’

Lower-wage workers — who tend to have fewer financial resources at their disposal — were hit hardest by the economic downturn.

The bottom fifth of earners (those making less than $490 a week) saw their jobless rate soar to nearly 20% in May, according to a paper published last month by University of Chicago economists. (In other words, 1 in 5 workers looking for a job couldn’t find one.)

Read the rest of the article here…

Most recent videos on YouTube!!!

- Homeowners & Landlords Will Suffer… The Back Rent Will Never Be Repaid

- The Fear Of Having Too Much Cash In Banks (Banking Crisis Coming Soon)

- The Federal Reserve Note Has Been Dethroned

[embedyt] https://www.youtube.com/watch?v=AZgQKDOy4a0[/embedyt]

0 Comments